Budget Wishlist

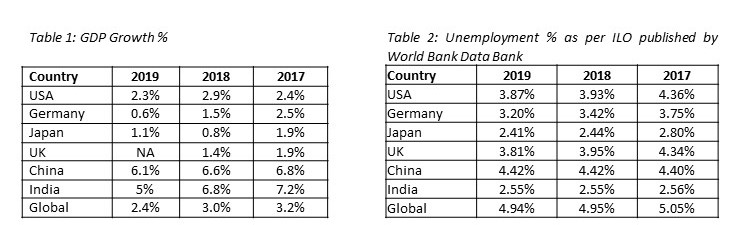

Over the past few months, the Government has sought to reform the corporate tax regime by reducing corporate tax rates, abolishing MAT etc., with a view to stimulating the economy. The Hon'ble Finance Minister has repeatedly expressed the Government's desire to provide relief to the capital market. But despite major changes to tax laws as well as other structural reforms, important economic indicators, including GDP, still point towards a slowdown. With this in mind, industry bodies are anticipating the Union Budget 2020 with both hope and apprehension in equal measure.

One of the persistent demands coming from industry bodies over the past few years has been to scrap Dividend Distribution Tax (DDT). Currently, companies/mutual funds are required to pay DDT at a flat rate and investors receive net dividend in their hands. Levy of DDT has substantially reduced the net dividend available in the hands of the taxpayers, which has made equity/mutual funds, as an asset class, slightly less attractive.

The taxation of dividend income in the hands of the shareholders has been subject to several changes over the last two decades.

Legislative intent and history

The legislative intent behind the introduction of DDT was to help make the collection of tax administratively easier, reduce the compliance burden on the taxpayer, and to mitigate potential double taxation. The amendments made to taxability of dividend income through various Finance Acts have been summarized below.

The Finance Act, 1997 inserted section 115-O, and section 10(34) of the Income-tax Act, 1961 ('IT Act') shifted the tax liability on dividend income from the shareholders to companies through the levy of DDT. Prior to the amendment, the shareholders were liable to pay tax upon receipt of dividend.

The above position was reversed by amendments introduced by the Finance Act, 2002 by virtue of which dividends were again made taxable in the hands of the shareholders. However, these amendments were short-lived and the Finance Act, 2003 reintroduced the levy of DDT. Section 115-O of the IT Act was further amended by Finance Act 2014 to provide for grossing-up of the DDT rate in order to ensure that DDT is levied on the gross amount of dividend and not on the net amount of dividend.

The Finance Act, 2017 introduced section 115BBDA to the IT Act whereby specified resident taxpayers (other than domestic companies) are subjected to additional tax at the rate of 10% (over and above DDT paid by companies/mutual funds). This is in addition to amended section 10(34) of the IT Act, which aims to bring certain high dividend earning taxpayers within the tax net.

Structural issues with the current regime

DDT being charged at a fixed rate has acted as a major impediment to taxpayers' acceptance of the regime in its current form. Further, DDT credit to recipient foreign shareholders has limited benefit because dividends are tax exempt in several countries (including the US and the UK) under some circumstances, and many countries do not give credit at all for DDT paid in India against tax liability in the home country.

Levy of DDT has also resulted in disallowances under section 14A of the IT Act. Section 14A of the IT Act provides for disallowance of such expenditure incurred in relation to income which does not form part of the total income, and is currently one of the most litigated sections under the IT Act. Section 14A of the IT Act is a major hurdle in the case of leveraged investments, as debt structures and leveraged acquisition structures face a huge tax hit on account of the same.

The way forward

DDT's contribution is expected to be approx. Rs 60,000 crore to the exchequer out of the total tax collection target of Rs 13.35 trillion for the current fiscal. Considering the revenue DDT generates for the government vis-à-vis the issues faced by the taxpayers, it is imperative that the provisions of DDT are scrapped, or that DDT is specifically characterized as a withholding tax.

Based on the news reports, the direct tax code task force, which submitted its report in August 2019, recommended abolishing DDT in order to maintain there being no differential treatment towards class of financial investor.

Even if the Government does not wish to scrap DDT, introduction of DDT in the form of withholding tax will substantially benefit the shareholders as most recipients will be able to claim the credit for the taxes withheld. Also, in the case of non-residents, the rates of withholding tax are typically much lower in most tax treaties compared to the DDT rate, thus resulting in potentially enhanced dividend pay outs. This should have a hugely positive impact on the sentiments of the investors, leading to enhanced investment in the country.

Should DDT reform be implemented, the Government would need to formulate a mechanism to capture the dividend declared/dividend paid by the companies in the system (similarly in line with Form No. 26AS) in order to ensure that the dividend income chargeable to tax does not escape the eyes of the law. Further, necessary amendments should also be made under the IT Act with respect to exemption from the filing of income-tax returns where dividend income is the only source of income for the taxpayer subject to appropriate taxes being withheld. This will also resonate with the legislative intent of 'Minimum Government Maximum Governance'.

The views expressed here are personal.

Multilateral Instrument (MLI) - one of the biggest reforms in international tax will be effective from 1 April 2020. This article tries to enlist various expectations from Budget 2020 with respect to implementation of MLI.

Base Erosion and Profit Shifting (BEPS) Action Plans incorporate the most important reforms in international tax at a global stage. In a rare occurrence, a large number of countries have come together in order to tackle the issue of tax evasion/ avoidance. One of the main concerns from a direct tax perspective has been the abuse/ misuse of the provisions of tax treaties. Considering the number of countries involved and number of tax treaties required to be amended, it was felt that the same could not be achieved within a reasonable time through bilateral negotiations. One of the BEPS Action Plans - Action Plan 15 - is the implementation of MLI - whereby a single multilateral treaty has been agreed which would amend bilateral treaties.

The process of implementation of MLI is that each country notifies which treaties it wishes to amend by designating that country's treaty as a Covered Tax Agreement (CTA). Under the MLI, there are certain minimum standards which each country is required to adopt. There is a degree of flexibility in terms of selecting options provided in various articles of MLI and each country is required to specify its position on each Article including reservations, if any. Bilateral treaties are amended only if the other country has also included the tax treaty with the first country as a CTA and the position adopted with respect to the respective article of the MLI matches. In the event both countries have included each other as CTA but none of the positions on other articles match, the bilateral treaty will be amended to the extent of the minimum standard.

The Union Cabinet approved MLI on 12 June 2019. India deposited the instrument of ratification with OECD on 25 June 2019. India has included tax treaties with 93 countries as CTA. Amendment to tax treaties will depend on other countries notifying treaty with India as CTA.

The first question which comes to mind is whether India has the legislative authority to implement MLI. It is a well settled principle that the Executive has a constitutional right to enter into international treaties. Under the income tax law, the power to enter into and apply provisions of a treaty is enshrined in Section 90. India has notified the text of the MLI and its position with respect to CTAs and various articles of MLI on 9 August 2019 under Section 90. There is a school of thought that the ultimate purpose of MLI is to amend bilateral treaties and hence the power to apply MLI is implicit in the provisions of Section 90.

The power to enter into a tax treaty, as envisaged in Section 90, has three key elements:

- The Central Government

- May enter into an agreement

- With the Government of any country outside India……

In case of MLI, the first two elements are satisfied - since Indian Government is ratifying MLI which under the Vienna Convention for treaties would qualify as a treaty or agreement. However, there may be questions as to whether the third element is satisfied. As on the date of depositing of the instrument of ratification - or for that matter even today - India does not know as to which treaties have been amended as a result of MLI. Thus, the third element may not be fulfilled and the power to apply the provisions of MLI to taxpayers may not be covered under Section 90.

In such a scenario, it may be prudent to amend the provisions of Section 90 so as to include the power to ratify MLI, adopt positions on various articles of MLI and make the provisions of MLI applicable to taxpayers. This new provision would also need to legislate that the minimum standard as envisioned in the MLI would be applicable to all treaties where the other country has included treaty with India as CTA. It also needs to state that the other provisions of MLI would apply only to the extent the other country's position matches the position adopted by India.

Further, information with respect to treaties which are amended as a result of MLI is not easily available. The new provision discussed above, also needs to make it mandatory for the Government to notify the treaties which are amended alongwith the effective date of such amendment. This will provide clarity to stakeholders with respect to the amendment in treaties.

In cases where treaty with other country has been amended, OECD provides the option to develop a Synthesized text of the treaty - which will include the original provisions of the treaty and the respective amendments made by MLI. India has released 12 Synthesized texts of treaties till date. As per the OECD Guidance, Synthesized text of the treaty cannot be a legally binding document. Hence, Synthesized texts released by India include a disclaimer. There is a possibility of errors in developing the Synthesized texts. Interestingly, the Australian Taxation Office has provided relief (by including a statement in the Synthesized text) that in case there is an error in the Synthesized text and the same is relied on, such a fact will be taken into account in determining the action required to be taken against taxpayers. A similar provision should be incorporated in the Indian tax law whereby no interest or penalty should be levied on taxpayers or professionals in case reliance is placed on an erroneous provision in the Synthesized text.

One of the minimum standards prescribed by MLI is the application of the Principle Purpose Test. In a nutshell, this concept entails denying tax treaty benefits when one of the main objects of a transaction/ arrangement is to obtain tax treaty benefits. This concept is somewhat similar to the domestic law concept of General Anti Avoidance Rules (GAAR) - though GAAR provisions cover many other situations (and not just treaty abuse). The Government needs to prescribe appropriate safeguards (similar to those prescribed for GAAR) in order to avoid inconsistent and indiscriminate application of the Principle Purpose Test.

India has also chosen to adopt modifications with respect to the criteria for determining existence of Permanent Establishment. These articles would apply in cases where the other country has also adopted similar positions. In such a scenario, a key question arises as to whether the Principle Purpose Test and stringent criteria for Permanent Establishment can be evaluated at the stage of determining withholding tax.

Both these issues require a detailed analysis, various documents and a holistic view of the payee's structure. A payee may not be inclined to share this information with the payer. Thus, these issues should ideally be analyzed at the time of framing the assessment. Hence, there should be an amendment to the withholding tax provisions so as to absolve the payer from addressing these issues at the time of determining withholding tax.

It is safe to say that a new chapter in international tax is about to written. In order to make a smooth transition, the changes discussed above need to be introduced in Budget 2020. In the absence of the same, stakeholders may challenge the implementation of MLI and allied issues before High Courts resulting in confusion and uncertainty. This needs to be avoided in order to achieve the key objective of BEPS to curtail tax evasion/ avoidance.

The recent Press Releases of the Government of India seem to indicate that the Sabka Vishwas (Legacy Dispute) Resolution Scheme, 2019 was a resounding success and has opened up the debate as to why the said Scheme garnered greater acceptance compared to the past dispute resolution schemes and specifically the Direct Tax Dispute Resolution Scheme, 2016.

Indian taxation has an interesting cycle. Firstly, the tax laws are quite complex and are frequently amended. Secondly, there are retrospective amendments, most of which are to nullify Court decisions. Thirdly, while evasion related disputes do exist, most of the issue-based tax disputes do not get resolved at the first or second level. Fourthly, it is a cat and mouse game since either the assessee or the revenue would go on appeal if the dispute is critical or the stakes are high. When matters are pending before the Commissioner (Appeals) or Tribunal or High Court or Supreme Court, there is an interest in closing the matters provided the closure is smooth and efficient. However, the most critical element is the waiver that is granted in the Scheme.

The success of the Sabka Vishwas Scheme, 2019 for excise and service tax matters can be attributed to the following.

(i) If the disputed tax was less than Rs. 50 lakhs, 70% of the tax was waived. Even for the payment of 30%, the amounts paid earlier during pendency was deductible. Interest and penalty were fully waived. This ensured that a very sweet deal was offered to disputes where the quantum was not significant.

(ii) If the disputed tax was more than Rs. 50 lakhs, 50% of the tax was waived. Even for the payment of 50%, the amounts paid earlier during pendency was deductible. Interest and penalty were fully waived. Assuming a matter was pending before the Tribunal, the assessee would have deposited atleast 10% of the disputed taxes as mandated by the statute. This percentage was higher in cases where the pre-deposit was ordered by the Tribunal before the amendment to Section 35F. Therefore, the amounts payable under the scheme after adjustment was not huge.

(iii) If there were arrears, i.e. when no appeal was filed and the demand was final, the applicant could close the matter by paying 40% of the taxes where the amount was less than Rs. 50 lakhs and by paying 50% of the taxes where the amount was more than Rs. 50 lakhs. The icing on the cake was the complete waiver of interest and penalties.

(iv) Where a person voluntarily disclosed tax liabilities, on payment of the entire amount of tax, interest and penalty was fully waived. In effect, the scheme was also a voluntary disclosure scheme.

(v) On settling the dispute in accordance with the Scheme, there was complete immunity from prosecution.

The reason for the Direct Tax Dispute Resolution Scheme, 2016 not tasting the same kind of success is quite obvious. In the said Scheme,

(i) If the disputed tax did not exceed Rs. 10 lakhs, the whole of the disputed tax and interest on the disputed tax till the date of assessment or reassessment was payable.

(ii) In other cases of disputed taxes, the whole of the disputed tax; entire interest on disputed taxes till the date of assessment or reassessment and 25% of the minimum penalty leviable was payable.

(iii) If penalty alone was disputed, 25% of the minimum penalty was payable apart from the tax and interest payable on the amount of total income finally determined.

(iv) If it pertained to specified tax, i.e. a determination of liability on account of retrospective amendment where a dispute was pending, the entire tax was payable under the Scheme.

The stark difference is the treatment of interest and penalty between both the Schemes. The message is loud and clear. The success of a scheme clearly depends upon what is being offered. In these days, where Insolvency and Bankruptcy Code, 2016 and the NCLT is in the news, there are reports of settlement of loans based on the banks and financial institutions agreeing for haircuts. While taxes, interest and penalties can be imposed in the order, unless recovery is possible and the assessee is in a position to pay, these are just numbers.

The fact that the Sabka Vishwas Scheme was successful does not necessarily mean that the assessee had lost hope in winning the matter and wanted to grab the opportunity. Most assessees took decisions for availing the benefit based on factors such as closing pending litigation, cleaning up their balance sheet, possibility of the dispute continuing at higher levels even if the assessee wins at the lower level and adverse decisions at a higher level which will have a bearing on the dispute. However, without the waiver of interest and penalty, the 2019 Scheme would not have been attractive. The Government of India and the Finance Ministry can take full credit for sensing the pulse of the assessee.

In the 2016 direct tax scheme, if there was an appeal which was only with reference to penalty, the Scheme required payment of 25% of the minimum penalty, whereas in the 2019 Scheme, nothing was payable and the matter was closed.

The 2016 Scheme had exclusions in respect of certain tax arrears and tax determined under certain provisions. This by itself diluted the scope of the Scheme. In contrast, under the 2019 Scheme, no such exclusion was contemplated within tax disputes.

Under the Direct Tax Dispute Resolution Scheme, 2016, a declaration under Section 202 shall be made to the designated authority in such form and verified in such manner as may be prescribed. However, under the Sabka Vishwas Scheme, the entire process is almost free from any interaction with the officials from the Department, leaving very little room for discretion or for undesirable practices.

Although the Direct Tax Dispute Resolution Scheme, 2016 did not gain popularity as much as the 2019 Scheme, the reason is not entirely based on the methods followed. The major incentive behind the Sabka Vishwas Scheme was the fact that the laws are pre- GST and consequentially, businesses wanted a closure in respect of pre-GST disputes. In contrast, the Income Tax Act, 1961 is an existing law. An assessee would prefer to continue to litigate for a particular year in order to get a decision in his favour which would be a binding precedent for the subsequent period. Even then, the possibility of success does exist given the fact that most of the direct tax disputes continue to exist only because binding precedents are not followed. An attractive Scheme would still find favour.

Essentials for a new scheme in direct tax

(i) There must be a significant percentage of waiver of disputed taxes and lessons can be learnt from the 2019 Scheme. Further, as in the 2019 Scheme, credit must be given for the taxes paid during the pendency of the dispute.

(ii) The entire interest and penalty should be waived.

(iii) Immunity from prosecution should be automatic.

(iv) Proceedings for prosecution for not deducting tax at source should be closed by a mere application since TDS is only a mechanism for advance collection of tax and the tax is still payable by the person earning the income.

(v) Proceedings for prosecution for not paying the tax deducted at source should be closed on payment of such taxes.

(vi) If any proceedings have been initiated under the Benami Act or PMLA pursuant to income tax proceedings, the same should abate on closure of the income tax proceedings.

(vii) All interest and penalty related to TDS matters must be waived.

(viii) Search and seizure cases can have a different waiver in terms of percentage of taxes but interest and penalty should be waived.

(ix) A window must be provided even for arrears of taxes where no appeal has been filed. The percentage must be as attractive as in the 2019 Scheme for Indirect Taxes.

(x) Where notices have been issued proposing taxes under Section 115BBE of the Income Tax Act, 1961, the matter should be closed on payment of 50% of the taxes as contemplated in the said provision or at the rates that existed prior to the amendment with effect from 01.04.2017. Further, interest and penalty should be waived.

(x) The Scheme should not exclude demonetization cases since one of the key objectives of the Scheme should be to garner revenue.

(xi) The Scheme should be carefully drafted taking into account the various issues faced in the 2019 Scheme which warranted four major circulars comprising of FAQs.

(xii) The entire process should be online without any necessity for interaction.

Interestingly, the awareness created for Sabka Vishwas by the Department has been phenomenal. For any Scheme to be successful, the assessee must be fully aware of the benefits under the Scheme. Therefore, the same degree of marketing should be carried out to ensure success of the direct tax scheme.

Budget 2020 Wishlist: 5 Key Transfer Pricing Recommendations

As economy grapples with slowdown, low growth and high inflation, Government has been proactive in terms of addressing sector-specific issues, bringing tax and regulatory reforms and moreover is also busy in balancing tax cuts and expenditure, with an aim to take India to USD 5 trillion economy by 2024-25. In this complex process, it is imperative for Government to also ensure that the Indian economy is sustainable, investor friendly, facilitates entrepreneurs and promotes growth from long term perspective.

As Amazon CEO Jeff Bezos predicts that the 21st century will be the century of India and talks about using global footprint to export Made in India goods, its time for the Government to reciprocate with welcome changes which will significantly improve the business sentiments and perception. As 2020 Union Budget is fast approaching, Government has rightly and proactively reached out to industry for opinions and suggestions with goals of reviving economy and improving ease of doing business in India.

Tax certainty, easy compliances, robust dispute resolution mechanism are some of the important factors that Government always endeavor to focus during the Union Budget. In ensuing paragraphs, we will touch upon some of the important points from India Transfer Pricing perspective which would require due attention from the Government in the upcoming 2020 Union Budget:

Safe harbour

India Safe Harbour Rules were introduced primarily to reduce transfer pricing disputes, to provide certainty to taxpayers and to align with industry expectations. However, it received a tepid response from taxpayers for multiple reasons - risk of economic double taxation, uncertainty on eligibility criteria and categorization of services, perceived high margins, etc. Revisiting the existing safe harbour provisions, which are set for renewal from FY 2019-20 and rationalizing them further would go a long way to promote Ease of doing business in India. Following are few recommendations that may be relevant:

· Rationalize safe harbour premium margins ranging from 17 to 24 percent for ITeS, KPO, software development and contract R&D services in light of range and multiple year concept introduced and margins concluded in APAs / MAPs;

· Option of Bilateral safe harbour between Competent Authorities of key trade partners such as US, Japan, UK, etc. may provide a worthwhile approach to simplify transfer pricing compliances;

· Introduce appropriate independent appellate procedure for cases where safe harbour benefit is denied;

· The applicability of safe harbour regime could be extended to transactions viz. non-binding investment advisory services, contract manufacturing, agency services, marketing and sales support, etc.

Secondary adjustment

Provision for secondary adjustment was amended vide Finance (No. 2) Act, 2019 whereby inter alia an option was given to the Assessee to pay additional income-tax at the rate of eighteen per cent on the excess money or part thereof which has not been repatriated within the prescribed time.

While this is a welcome step, the provision places a significantly higher tax burden on a taxpayer that avails this option vis-à-vis a taxpayer who does not. In the following example, Scenario 1 is where the taxpayer choses to repatriate excess money to India and Scenario 2 is where the taxpayer opts to pay additional income-tax in lieu of repatriation.

|

Scenario 1 (excess money repatriated) |

Scenario 2 (opts for paying additional tax) |

|

Primary adjustment (TP adjustment) |

100 |

100 |

|

|

|

|

Income-tax (30% + 12% SC + 4% cess) |

34.94 |

34.94 |

Additional tax (18% + 12% SC + 4% cess) |

NA |

20.97 |

|

65.06 |

44.09 |

|

|

|

|

|

DDT (assuming dividend is paid) |

13.37 |

|

|

|

|

|

Tax cost (Corporate tax + DDT) |

48.31 |

|

Tax cost (Corporate tax + Additional Tax) |

|

55.91 |

This provision appears to have been inserted so that government is compensated for dividend distribution tax. In the budget, if dividend distribution tax is abolished, it would also be imperative to ensure that above provision of paying additional tax on excess money not repatriated should also be removed / amended appropriately.

Alternatively, necessary amendments could be made in Section 92CE(2A) to state that additional tax ought to be applied on primary adjustment as reduced by the amount of normal income tax. In the above example (Scenario 2), additional tax could be levied on 65.06 (100-34.94) rather than 100.

There could be divergent views / scenarios considering the facts of each taxpayer.

Align India TP provisions with globally accepted norms

Since Transfer Pricing is a bilateral / multilateral subject it is important that provisions are align with globally accepted norms. Following are some of the instances, where India could initiate and align with global norms:

· Rule 10CA of the Income-tax Rules, 1962 elaborates on how arm's length price needs to be computed using multiple year data and range concept. Requirement of at least six comparable companies, narrow range of 35th to 65th percentile, importance of analysing current year data (which may not be available at the time of preparing TP study), median v/s arithmetic mean, +/- 3 / 1 percent variation (await for notification every year), multiple year analysis does not apply if most appropriate method used is CUP method, PSM or Other Method (Rule 10AB), range concept does not apply to PSM or Other Method and many other such stringent conditions make the process of determining arm's length price / margin very complex and cumbersome exercise. Computational aspects could be simplified and aligned with global norms.

· Rule 10CA of the Rules provides for the use of multiple year data for the comparables. The use of multiple year data should be extended to tested party as well to have parity in the comparability analysis. Every industry and product go through business cycle and its performance has an impact over a period of time. Just like use of multiple year data evens out the impact of business/ product cycles for comparables, it does so for the tested party as well.

· As of now, assessment is carried out separately for each assessment year irrespective of the nature of the issue. Block assessment for 3-5 years may be considered, if not in general, for transactions such as royalty, intra-group services, etc., as they are cyclical in nature and mostly have an impact over a period. A detailed assessment in the first year of the prescribed block should be made applicable for the remaining years of the block. Like what has been adopted as part of the APA process, the Government can get certain conditions to be fulfilled, included in the rules (no change in facts and circumstances year-on-year etc.). This practice is followed internationally as well and aligns with global best practices.

· There is an urgent need to prescribe detail guidance to the field officers and taxpayers on what sort of details need to be collated / analysed for various complex transactions / situations such as intra-group payments, royalty transactions, marketing intangibles, guarantees, intra-group loans, etc., economic adjustments (working capital / risk adjustment), quantitative filters to be applied during search for comparable companies, how to compute PLIs, factors to be considered in analysing DEMPE functions and many more. Various principle laid down by Tribunals and Courts could be leveraged.

· With respect to the Master File required to be filed in India, Rule 10DA of the Rules prescribes threshold and various details that needs to be filed in Form No. 3CEAA, which is generally in line with OECD template. However, there are certain additional details that needs to be filed in India. To align with the recommendations of the OECD, India could do away with such incremental information and may also want to increase the prescribed threshold to make it applicable only to large entities.

Advance Pricing Agreement

The Indian APA programme has matured over the years since its commencement in July 2012. Complex transfer pricing issues, which were prone to long drawn litigation, are being increasingly resolved through APAs. The resolutions have been to the satisfaction of both taxpayers and the Government. However, there is a need to increase the headcount / resources in APA program, so that huge backlog of APA cases can be resolved amicably. In Union Budget speech, Honorable Finance Minister could announce some significant steps to strengthen the APA program which would boost investors' confidence.

Interest deduction limitation

India is a developing country with a need for foreign investments to fund various initiatives, in particular the development of India's infrastructure. Accordingly, the above provision of Section 94B limiting interest deduction should be done away entirely or at least deferred for 5-10 years to give India an opportunity to achieve its anticipated growth through required infrastructural development and maturity. The exclusions granted to banking and insurance companies should also be extended to other sectors such as NBFCs, large capital-intensive companies with long gestation periods and companies in real estate and infrastructure sector. The Government may consider allowing carry forward of excess interest for a longer period, say 15 years, instead of prescribed 8 years to cushion long gestation periods for such industries. Further, the word 'implicit guarantee' should be dropped from the provisions. The term 'explicit guarantee' should also be appropriately defined to obviate future litigation on this front. The mechanism to calculate EBITDA should be clearly laid down.

As the Modi Government 2.0 braces itself to present its second budget on 01 February 2020, anticipations of the taxpayers continue to soar in the countdown to the D-day. Ever since our Finance Minister Mrs Nirmala Sitharaman doled out jaw-dropping tax concessions for corporates in September last year, the euphoria amongst the personal taxpayers that the FM shall loosen her purse strings for them is at an all-time high.

While it is customary for FMs to be 'under the gun' around the Budget time, never in the years gone by has someone been subjected to this sort of acute pressure. Headlines like 'At 5%, GDP growth to hit 11-year low in FY20'; 'Sharp slowdown in India a drag on world economy: IMF', do no good & rather mount the Aam Aadmi's anxiety, whilst presenting a grim picture of our economy. The Government on the other hand has rightly asserted that India's economic fundamentals remain strong and one should be optimistic about the future.

Wanting to get over the colonial hangover, the FM last year dumped the traditional leather briefcase in favour of a red cloth-bag (Bahi-khata) - thereby breaking the norm. One hopes that she similarly institutes path-breaking reforms on the personal tax front too - spurring consumption by putting more money in the hands of the taxpayers as well as serving as a catalyst for resurrecting the growth momentum in India's march towards its ambitious USD 5 trillion economy goal.

With this background, let's delve into some options on the tax front for the FM for this Budget:

è Reducing personal income-tax rates and/or bringing down the GST rates

Having regard to the slashed corporate tax rates, the time is ideal for a relook at the personal tax slab rates (illustratively introduce a 10% rate for income between INR 5 lakh to INR 10 lakh and have a 20% rate for income above INR 10 lakh to INR 20 lakh) and also for eliminating/reducing all surcharges. This could be considered as a reward to the taxpaying population encouraging them to spend this largesse and providing the much-needed adrenaline shot for consumption. The basic threshold of INR 2.5 lakhs is not expected to undergo any change to balance the number of taxpayers and return filers, such number being fairly modest as on date. Based on media reports, it appears that the taskforce on the Direct Tax Code has also suggested a considerable revamp of the present day tax slabs.

A variation of the above could be a sweeping overhaul in the personal tax regime in sync with the scheme enacted for corporates last year i.e. lower/flat tax rate if all deductions/exemptions are foregone. While this would simplify the tax regime significantly, the challenge with such a sweeping overhaul is that the Government will no longer be able to direct investments and savings into certain specific instruments.

An alternate proposal that will help all citizens is to reduce the overall GST rates appropriately, which in turn should help reduce prices and hopefully galvanize demand/production.

While introduction of either of these two ideas will increase the fiscal deficit, it is imperative to spur demand led growth in the economy by putting money in the hands of the people through such measures and through Direct Benefit Transfer schemes.

è Hiking the threshold of deduction under section 80C

The deduction limit under section 80C was last enhanced way back in July 2014. Due to the not so significant upper cap, various investment schemes have lost their sheen. Raising this limit will boost savings and foster investments by people. With an increase in the limit to at least INR 2.5 lakhs from the present limit, a salaried individual could enjoy a considerable increase in tax-free income.

This move would incentivise savings and thus become a win-win situation for the taxpayers and the Government (eg infrastructure is one area where significant investment is to be done by the Government and savings could be directed into infrastructure linked instruments).

è Making NPS more attractive

Despite the numerous tax breaks, NPS is still not the instrument of choice for most people. The tax deduction offered for employee's contribution under section 80CCD(1B) should be enhanced from INR 50,000 to at least INR 1,00,000. Secondly, the deduction threshold for the employer's contribution under section 80CCD(2) needs to be revisited to bring in parity between the Central Government employees (employer's contribution tax-free up to 14% of salary) and other subscriber classes (deduction restricted to 10%).

è Augmenting LTA Benefits:

Currently, exemption is allowed for employees on the amount they spend on their cost of travel within India. This benefit can only be availed twice in a block of four calendar years. Such exemption should be granted every year to boost India's tourism industry and calendar year methodology should be changed to financial year.

è Streamlining the LTCG tax regime - tax rates & tenures

Although it would be a daunting task for the Government to eliminate tax on LTCG just two years after it was introduced, some sort of rejig may be considered. This would also be in line with PM Modi's speech in New York last September, where he promised foreign investors that the Government was working towards “bringing tax on equity investments in line with global standards.”

In times when the equity markets have sky-rocketed to new heights, the FM could consider doubling the extant tax-free LTCG ceiling from INR 1 lakh to INR 2 lakhs.

On a related note, the holding period to qualify as 'long-term' for equity funds is 12 months, 24 months for immovable property and 36 months for gold and all other mutual/overseas funds. Even the tax rates differ. The holding period and tax rates across various asset classes could be standardised to fuel investments in the debt and gold market.

è Abolishing DDT

Today, an Indian company has to pay DDT on the declaration of dividends, which are consequently exempt in the hands of shareholders.

It is anticipated that the FM shall abolish DDT, thereby shifting the tax incidence from the company declaring the dividend to the shareholder receiving it. If scrapped, this step will undeniably be applauded by the foreign investors who can consider relief available under double tax avoidance agreements without any litigation risk. At the same time, dividends will be taxed in the hands of the Indian promoters/investors and here a capping of the rate of tax to a maximum of 30% may be considered along with an appropriate base line exemption.

è Rationalising Employee Stock Option Plan (ESOP) taxation

Indian corporates (particularly start-ups) use ESOPs as a powerful tool to attract, retain and remunerate talent.

A fundamental issue that arises is whether ESOP taxation should happen only when an employee sells the shares (allotted pursuant to exercise) as against both share allotment & sale stages (as on today). There are cash flow issues where perquisite taxation takes place at the share allotment stage (when no money actually flows in the employees' hands) together with issues as regards valuation in the case of unlisted/foreign companies.

The demand from corporates & mainly start-ups is to push taxation of ESOPs to the liquidity event (of sale) as this will greatly heighten the traction of ESOPs as a lucrative compensation item.

è Reverting to the previous belated/revised return deadline

Earlier, taxpayers were allowed to file belated/revised returns till one year from the expiry of the relevant assessment year. Presently, taxpayers can file a belated/revised return only till the end of the same assessment year.

This change has caused perplexity amongst loads of individual taxpayers leading to undue hardship - most notable being the expatriate population taxable on worldwide income (foreign tax returns not finalized till 31 July due to fiscal year vs calendar year incongruity). Drifting back to the earlier deadline would allow ample time to such individuals to collate the required documentation to avoid double taxation on the same income.

In the backdrop of so many expectations, the following quote used by the FM in her July's Budget Speech comes to mind - “Yaanai Pugundha Nilam.” This essentially means that " An elephant will be happy to have two mounds of rice from a paddy field, but if it enters the land, it will have far less to eat than it will trample." Drawing an inference from this quote, she further said that the incumbent Government is happy to collect only as much taxes as are necessary, and won't be crushing the taxpayers.

As our FM walks the tightrope, she faces the onerous task of striking a balance between India's towering aspirations to become a USD 5 trillion economy and fiscal prudence. The need of the hour is to provide a thrust to consumption led demand and get the Indian economy back on a high growth trajectory. Will Mrs Sitharaman be able to pull off this Houdini's act? Well, let's wait and watch.

India introduced a 'patent box tax regime' in 2016. The idea was to incentivise the innovators to innovate, create intellectual properties in the form of patents by giving a huge tax concession on the income earned from the licensing of the patents. This was meant to serve several purposes : foster innovation in the country, retain talent and arrest brain drain, provide home grown technology and innovation for use in home grown businesses and make it more cost effective as well as save forex outflow, utilise the immense young talent and resources in the country for innovations which are customised to suit Indian conditions rather than borrow something which may not be suitable in Indian situation et al.

Judging by less than lukewarm response to this regime, it appears that tax is not necessarily the only incentive that would inspire creation of intellectual property ('IP”) and development of patents in India. A whole eco system needs to be evolved to create sufficient level of interest for growth of IP creation in India.

Many countries around the world have implemented specialised IP Regime or similar regime for taxing income related to IP at low rate. The Taxsutra compilation “Unboxing the Patent Box Regime”[1] has identified as many as 28 countries around the world that have such specialised tax regime. Such low tax regimes in these countries attracted legal ownership of IP created elsewhere in the world. The legal owner benefited from paying low tax on the income earned from the IP. In majority of the jurisdictions, the beneficial provisions of tax are available to a wider variety of income in connection with IP, and the definition of IP for this purpose is much wider.

The following examples make this point clear :

In the UK- the qualifying assets include Patent granted by the UK Intellectual Property Office, patent granted by some, but not all, states in the European Economic Area and certain other European IP rights (eg., SPCs, plant breeders' rights, plant variety rights);

In Belgium, the qualifying assets are Patents and SPCs, Copyright-protected software produced as part of a R&D project, Data and marketing exclusivity IP, Designations for orphan drugs and Plant variety rights;

In Ireland, the qualifying assets are : Patents, Copyrighted Software, other intellectual property that is similar to an invention that could be patented (Category3)

In the Netherlands, the qualifying assets are : Patents, Copyrighted Software, other intellectual property that is similar to an invention that could be patented (Category 3). Benefit is granted to royalty income and capital gains from these assets

In Israel, there are 3 different regimes and the benefit is granted to income from the qualifying assets and capital gains derived.

France offers reduced rate for long term capital gains and profits from the licensing of IP rights for patents

Korea has special taxation for transfer, acquisition, etc. of technology which includes patents and Category 3 IP

In many cases, the tax benefit is given to income which is computed using a formula. The income for this purpose includes the income from transfer of IP. Several of these regimes had come under investigation and attack from the OECD, branding them to be harmful tax practices. However, all those listed above have now been amended to be compliant with OECD's standard of 'Nexus Approach'. This approach of taxation permits the beneficial regime for income arising from IP if substantial research activities were undertaken in that jurisdiction.

For India, this approach is very welcome. It provides a significant opportunity to create a whole ecosystem for creation, ownership, transfer and commercial exploitation of IP in India and outside India. While the Patent Box Regime introduced in 2016 was to provide this ecosystem, somehow, it has either not been publicised enough and/ or is not found practical enough to be used. A few of the issues that come to the fore through discussions with relevant stakeholders are:

(a) The definition of patent is very narrow and rigid. This needs to be substantially expanded to include software and IP similar to patent as many other countries have done

(b) The legal regime for the protection of IP needs to be tighter and must give meaningful protection for infringement of IP right including damages and immediate ban on such infringement.

(c) No expense for producing IP is permitted against the income of IP which is taxed only at 10%. This is a major hurdle. In some cases the person creating IP (currently it is only patent) needs to spend a lot of time, effort and money before patent can be registered.

(d) It takes years for the patent to be granted.

(e) Due to exchange control regulations, the income which is received by the IP owner may get trapped in India and it may not be possible for such IP owner to really unlock the value that is possible in the international market

Clearly, some more thinking needs to be devoted to fine tune this very useful tax regime, to address the above and more concerns and take advantage of the immense potential that it offers. Some of the possible benefits that can be reaped are discussed below. This is by no means an exhaustive list. It is a merely illustrative:

(i) The Indian rural and humble areas are rife with stories and instances of youth having hugely innovative ideas and models. This suggests that India has one of the largest manpower available to develop IP. By providing incentive to create IP which has the possibility to open doors to prosperity using the knowledge power, a significant job opportunity can be created. Many a times unemployable youth is also very creative and given the right environment and opportunity through easily accessible institutions, such youths are not only gainfully employed but pave way for gainful employment of many if the IP created is commercially exploitable.

(ii) India has its own environment, climatic and geographic conditions, and social and sociological belief systems. By themselves this variety and variation provide immense opportunities which are not necessarily satisfied by importing IP created to suit entirely different type of life in other countries. Importing such IPs for betterment of human life has been useful and made India integrate well with the rest of the world. But significant costs have been paid for this, including but not limited to the flight of Indian intellectual capital and loss of foreign exchange. By providing opportunities to create domestic IP which can be better suited for Indian scenario, India should be able to arrest both these costs.

(iii) Availability of funding and institutions to facilitate and encourage such creativity and IP creation is a big issue. While in India we probably have one of the largest number of universities, there is hardly any innovative work being produced at such universities. This needs to be changed fundamentally. This compares poorly with the fact that most highly regarded universities across the world have a huge number of patents and IP to their credit. Universities can be permitted to be funded through Corporate Social Responsibility expense to promote creativity and more importantly creation of commercially exploitable original IP. They may also be financed by other domestic NGOs (not funded by foreign contributions) as well as dedicated government funding agencies. Indeed, a lot of work needs to be done to put in place the whole eco system for this purpose. This can be put on the agenda of the HRD Ministry along with the other relevant ministries.

(iv) For creating funding to promote this, educational institutions may also be funded for specific researches by corporations by creating their 'seats of excellence' and establishing 'scholarships'. The research needs should be identified, taking into consideration the requirements of the country : e.g. conversion of daily waste into producing energy and fertile soil, desalination of sea water, creation of platforms for providing human development services, creation of platforms to ensure that people are made aware of all government benefit schemes, creating platforms to educate people of changes in civic laws which impact their daily lives, inexpensive and easily usable energy and water saving devices and so on. The list can be unending.

(v) The universities or the educational institutions can own the IP and sell it to businesses for commercial exploitation. This could thus become self-financing for educational institutions. This can also be a major source of incentive to educational institutions to promote creation of IP. Teachers and guides who are disillusioned due to lack of opportunities for doing such intellectual work would find their intellect being well rewarded.

(vi) The Indian businesses, which acquire the IP from Indian educational institutions should get the advantage of 'IP” or “patent box” taxation regime, since the IP would have been created in India.

(vii) Most importantly, Indian businesses should be able to manufacture products using the home grown IP which they would acquire. These products would not only be extensively used in India but can also be exported competitively across the world, using the indigenous but excellently created IP. This can give a great impetus to 'Make in India' initiative.

(viii) This whole process would have several advantages :

a. Corporations which provide funding could get deduction under section 80G to the extent they are eligible and they would not have to worry about providing guidance, apparatus et al to create the IP nor be exposed to tax litigation when they claim deduction for the R&D spending or be accountable to their stakeholders for success or failure of the R&D since they would not actually be doing the R&D. Alternatively, they would be able to meet their CSR spending responsibilities.

b. Universities and educational institutions would be able to create seats of excellence and channelize the intelligentsia towards creative and productive work which can be rewarded

c. The same people who create the IP may also be hired by the corporations to keep updating the IP to be better exploited commercially

In conclusion, it can be said that a lot more thinking can be put behind a simple looking Patent Box Tax Regime, which has the potential to deliver on a lot of issues faced by the country. It can engage the youth gainfully and channelise their energy, harness the intellect of the youth and the teachers meaningfully, create a repository of rich intellectual property suitable for commercial exploitation, arrest outflow of intellectual capital from the country, reduce cost of better living in the country et al. It seems that there is a strong case to develop the “IP Box Tax Regime” in India with a lot more work behind it so that it does indeed deliver on its advantages.

The views expressed here are the personal views of the author and not of Cyril Amarchand Mangaldas. This article is neither meant to provide legal analysis nor any advice pertaining to the topic.

On February 1, 2020, the Modi 2.0 Government is to deliver its second budget in one of the most challenging economic environments in recent years. With very little fiscal space, all eyes are on the Hon'ble Finance Minister to conjure some magic. One of the most vibrant sectors in recent years, not only in India but also in rest of the world is the Technology sector, including IT, BPO as well as the newer age start-ups. The Technology sector, with the potential it possesses to substantially contribute towards taking the Indian economy to a USD 5 trillion mark by 2024, is eyeing the budget announcement with huge expectations. With technology sector contributing around 6.5% of India's total GDP and growing rapidly even in the current challenging environment, this is certainly a sector which should get Government attention. It is of course a tight rope for the Government, but if there is a sector which the Government should bet on, it is this.

Within technology sector, the Information technology - Business process management ('IT-BPM') industry is projected to grow from USD 177 billion in FY 2019 to USD 350 billion in FY 2025. The Indian e-commerce market size is expected to grow from USD 45 billion to exceed 100 billion USD by 2022. Further, digital revenues are set to grow from around 20% of the total IT-BPM Industry revenues to reach 38% by 2025. With more than 7200 start-ups, India is the world's 3rd largest startup community. With 16 unicorns, India already stands 4th globally in terms of number of unicorns[1]. As per NASSCOM report on “Indian Tech Start-up Ecosystem - Leading the 20's”, Indian start-up ecosystem continued to attract investors' interest with almost USD 4.48 billion of funding in 2019 (January to September). While such growth in the sector will have a multiplier, with jobs and other collateral development, the realization of its potential does require a careful nurturing of this sunrise sector. Steps are being taken by the Government in various areas including tax, but more is needed.

The Industry players are, therefore, keenly watching out and hoping for a supportive tax eco-system, some elements of which are outlined below:

· The tax laws currently provide for a low rate of tax of 15% for manufacturing companies. This policy is based on the approach, inter-alia, that investment in manufacturing creates a large number of jobs and hence, it needs to be incentivized. However, this needs to be balanced with a few trends that we have been witnessing in the recent years. Large scale manufacturing also needs large amounts of land, water and other resources which are scarce and can pose a challenge in our country. Further, with the impact of technology in manufacturing processes and practices, the numbers of jobs created by newer manufacturing establishments is reducing.

On the other side, the services sector, including specifically the technology sector is contributing very meaningfully. The large job-creation by IT/BPM sectors in recent years has been exemplary and needs no exposition. However, even the other parts of the technology sector, such as start-ups, e-commerce etc are creating a vibrant job market. In fact, the whole concept of the gig economy, which is a key trend in the job market in the recent years, is fueled by the Technology sector. As per a research conducted by NASSCOM, in the Financial Year (FY) 19, the Technology sector employed 4.1 million work-force directly, with around 6.5 lakh employees added from FY 15 and another 10 million indirectly. While the start-ups and non-IT/BPM share in the above numbers may be small, but is material and marching forward rapidly.

In light of the above discussion, given the potential of the Technology sector, it is time that the Government re-considers their hypothesis that large scale job-creation is the domain of only manufacturing, and widens the ambit of the lower 15% tax rate to also include Technology companies.

· The above ask for the concessional rate of tax is for the Technology companies operating in the domestic sector. Separately, IT/BPM sector which operates in the export segment with a significant portion operating through SEZs have been one of the contributors of foreign exchange and employment generation in the last several years. As per the fact sheet of SEZ, in FY 2018-19, the exports from SEZs has grown at 21% vis-à-vis earlier year and as on September 30, 2019, the exports have grown at 14.46% over the exports of corresponding period. The total employment has increased from 1.34 lacs as on February 2006 to 21.95 lacs as on September 30, 2019. As at September 30, 2019, SEZs had attracted investments of INR 5.21 lac crores vis-à-vis 4K crore as on February 2006[2]. Of course, it can be debated whether SEZs have performed as well as similar zones in other parts of the world such as in China, however, such comparison would also require consideration of other challenges in the Indian context around resource availability and other infrastructure. Given some of these challenges, arguably, the SEZs have performed reasonably well. The supportive fiscal framework for SEZs has been a key element contributing to the performance of the SEZ's. The tax holiday under section 10AA is an important cog in that wheel. The tax holiday comes to an end on March 31, 2020. However, in the back-drop of the above context, in order to continue promoting investment in SEZs including promoting exports and employment generation, it becomes imperative to extend the tax holiday by at-least another 5 more years. Needless to mention, that any such tax holiday, to be really meaningful should be introduced without MAT, which historically had significantly diluted the benefit of the tax holiday.

· Continuing with the MAT theme, owing to the above-mentioned (and other) tax holidays available, companies in IT/BPM paid taxes under MAT. Such MAT is available as a credit as these tax holidays end and the companies start paying normal taxes. Thereby, it ensures that through the utilization of the MAT credits, the tax holidays that were provided can be regarded as true tax holidays, with MAT only being an advance tax paid, which is creditable subsequently. However, now, with the lowering of tax rates earlier in the fiscal year (which can be opted for by such IT/BPM companies), such MAT credit utilization should not be available, since that seems to be the intent of the new rules, as per the clarification provided by the Government. If such MAT credit is unavailable, effectively, the tax holiday years, in hind-sight, cannot be regarded as real tax holidays. Admittedly, it's a policy choice, and the counter-argument is that even the headline rates are being lowered. However, the lowering of the headline rate is consistent with the trends in the rest of the world and in the region, and, at least for this critical sector, it should not come with this conundrum of choice.

In order to encourage such companies to opt for concessional tax rate, the Government should make amendment to allow the companies to utilize the MAT credit as a tax credit from normal tax payable like withholding tax credit.

· As per section 35(2AB) of Income Tax Act, weighted deduction of 150% allowed will be discontinued from 1st April 2020. This currently is not relevant to Technology companies since this incentive is only available for manufacturing businesses. There is tremendous amount of innovation happening in the technology sector. As per NASSCOM, a majority of the close to 5,000 patents filed by Indian companies in the US between 2015 and 2018 were in the technology sector. The shares of the technology patents in total patents in 2017-18 was greater than 60%. Artificial Intelligence and Internet of Things have the biggest share with cyber security, cloud computing the other kay domains. Countries like China and Indonesia probably recognize that Research and Development ('R&D') and innovation straddle across all sectors today and hence, provide weighted incentive to encourage R&D across the economy. China released a circular to expand the applicability of the 175% R&D super deduction rate to all Chinese enterprises. Similarly, Indonesian Government encourages businesses to conduct R&D activities, for which maximum of 300% of total R&D expenses over period is given all Indonesian corporation.

Such R&D is obviously expensive and any helping hand from the Government would be a great policy choice. Considering the emergence of new technologies and the innovative trend to be continued in future, to encourage more R&D and innovation in the sector, weighted deduction on R&D expenditure incurred should be extended beyond 31 March, 2020 and further, the same should be extended to the Technology sector as well.

· Protracted tax litigation is one of the key challenges in India. Companies in IT/BPM Sector are also litigating very old disputes at various forums of Courts which leads to unproductive time and effort both for the Government and taxpayers. Government launched a great initiative on the Indirect Tax sidein order to settle old disputes. The aim of Sabka Vishwas (Legacy Dispute Resolution) Scheme, 2019 was to help taxpayers in clearing the old disputes under legacy taxes (Service Tax and Central Excise), which are subsumed in Goods and Service Tax ('GST'). The scheme has shown some success with 26,142 applications amounting to INR 16,007.01 crores unlocked revenues for the Government as on November 2019[3]. While this scheme was especially relevant in light of the introduction of GST, a similar option is needed on the direct tax side as well.

Implementing such a scheme should not only close the litigations from the company stand point but also unlock immediate revenues for the Government without waiting for the ultimate outcome.

The start-up eco-system is one of the great success stories of India. This eco-system is putting India on the innovation map of the world. It is providing unique opportunities to the aspiring and innovative youth of our country and is a great boon for the consumers as well. This sector merits special attention. A few areas for this sector which need intervention are as follows:

· For startups, the most prominent way to remunerate its employees has always been by way of ESOPs. Currently, ESOPs are taxed at 2 stages, as perquisites - when an employee exercises the options, and as Capital gains - when an employee sells the shares. Taxing ESOPs before realization of sale proceeds results in significant cash outflow for employees. Further, most employees may not be able to pay tax. ESOPs, thus, becomes a serious tax problem for employees. This acts as a disincentive for startups to provide ESOPs to their employees. Therefore, the event for tax outflow should coincide with the liquidity event. Hence, ESOPs should be taxed only at the time of exit only rather than at the time of exercise as well.

· Another way in which this eco-system can be nurtured is by not taxing gains made by investors from investments in such start-ups. Countries like UK have such a regime where such gains are not taxed. News reports suggested that the Department for Promotion of Industry and Internal Trade Tax has considered this and is also supportive of this. To ensure that this does not turn into largesse, this could be linked to some re-investment criteria for the investors. This would give further fillip to an already vibrant investor eco-system.

· Start-ups incur heavy losses in the initial year of setup. In order to promote the new-age towards innovation, and encourage to set-up new businesses, carry forward of losses to startups should be allowed for at least 15 years as against 8 years.

Can the expectations meet reality for the technology sector? Will Government provide enough impetus to the sector including the start-up eco systems to keep its momentum going? We need to wait and watch!!!!

In recent years, government has taken various proactive steps to address the concerns of Start-ups and has also provided various tax and non-tax incentives to bolster the start-up ecosystem in India. From introducing the Start-up India Scheme, establishing Fund of Funds for investments of around 10,000 Crores to taking measures to put the devil of Angel tax to rest, the government has come a long way in fostering Start-ups in India.

The Union Budget 2019 introduced a series of measures for promoting start-ups such as expanding the scope of exemption from the Angel tax, rationalizing the provisions for carry forward of losses and extending sunset date for exemption from Capital Gains on sale of residential property on investment in Start-up. However, in the wake of the current economic slowdown, declining consumption and muted industrial output, there is a need to reignite the development of Start-up ecosystem in India.

What to expect from Budget?

Rationalizing provisions of section 79 for carry forward of losses:

Finance Act 2019 had relaxed the provisions for carry forward of losses for start-ups wherein even if there is a change in shareholding of more than 51% from the year in which losses were incurred, the start-up would be eligible to set-off the losses if all the shareholders of the Company who held shares at the end of the year in which losses are incurred continue to hold those shares in the year in which losses are being set-off. Although this move was welcomed by the start-up community, it did a little to achieve the purpose of allowing the start-ups to utilize the losses incurred in the early stage of operations as it is common for the founders or the promoters and even the investors to exit the company at attractive valuation after staying on board for just 3 to 5 years.

Further, the period for which the Start-up may carry forward losses is same as other companies i.e. 8 years. Considering the innate business model that involves significant cash burn and huge initial investment, Start Ups may take a while before they start making profits and may not be able to utilize the losses as they might have lapsed on account of subsequent rounds of funding.

In view of these difficulties, one may expect the government to amend section 79 of the IT Act for Start-up companies enhancing the period for the losses can be carried forward from current limit of 8 years and relaxing the conditions on shareholding pattern.

Extending the tax holiday for larger start-ups:

Section 80-IAC of the IT Act provides 100% deduction of the profits earned by 'eligible start-ups' engaged in innovation, development or improvement of products for a period of 3 consecutive years out of 7 years from incorporation. In order to be an eligible start-up; among other conditions, the turnover of the business should not exceed INR 25 Crores.

This acts as a deterrent for the start-up to scale up their operations as the start-up shall lose the tax holiday on achieving the threshold turnover. In order to promote start-ups to increase their global footprints and achieve scale of growth, the tax holiday under section 80-IAC may be extended to start-ups even with the higher turnover say 100 Crore.

As per the Department for Promotion of Industry and Internal Trade ('DPIIT'), the threshold for turnover to qualify as a start-up is INR 100 Crores. According to the notification[1] issued by DPIIT in February 2019, an entity shall be considered as a start-up:

i. Upto a period of 10 years from the date of incorporation.

ii. Turnover of the entity for any of the financial years since incorporation has not exceeded INR 100 Crores.

iii. Entity is working towards innovation, development or improvement of products or processes or services, or if it is a scalable business model with a high potential of employment generation or wealth creation.

In order to bring uniformity, the same criteria may be introduced in the Income Tax Act.

Lowering Rate on Capital Gains:

In a highly competitive market like India, funding is nothing less than oxygen for the start-ups to stay afloat and thrive. While primary infusion in the start-ups has been taken care by providing relief from Angel tax, the secondary market for the start-up companies may be developed by incentivizing the investors with lower rate of Capital Gains tax.

Currently, the Long-term capital gains derived from sale of shares of listed company is taxed at 10%[2] and Short-term capital gains (STCG) is taxed at 15%2. No such concession is available for sale of shares of start-ups. This leaves no room for investments in Start-ups vis-à-vis investment in stock market as far as tax is concerned.

Whilst there is a buzz about the government doing away with the capital gains tax on shares and securities it remains to be seen if the same is translated into action. Even if the capital gain tax remains, with a view to make the investments in Start-ups more liquid and attractive, the Budget may introduce a concessional rate of tax on capital gains on sale on shares of start-ups fulfilling certain conditions. The tax rates may be brought in line with the rates applicable to gains derived in stock market to promote investment in start-ups. This may be a useful tool in the scenario where the government is struggling to find employment generating avenues.

Reducing Compliance time:

The government has been rigorously improving India's position in Ease of Doing Business (EODB) ranking. Under the current government, India has made a commendable jump in EODB rankings. Currently, India stands at 63rd position among 190 countries.

Further, the compliance time for Start-ups has been in the limelight for quite some time. In the Start-up India Vision 2024, it has been proposed to cut the compliance time for start-ups to just one hour per month.

In line with the Start-up India Vision plan and sincere efforts by government to improve the EODB rankings, one may expect positive announcement from the Finance Minister on the Budget day on compliance aspects like GST Returns, TDS Returns, etc.

Conclusion:

Considering that the corporate tax rate has already been by way of an ordinance, a cut in personal tax has been in the limelight for the Budget 2020. It remains to been seen whether the expectations of start-up ecosystem will be met by the government. Considering that the government has been proactive in addressing the concerns of Start Up's, one could expect the Budget 2020 to come up with additional measures to give a fillip to the Start Up ecosystem.

This Article has been co-authored by Riddhesh Shah(Associate).

A. Backdrop

Tax disputes lock up substantial resources of both the taxpayer and the government. The Central Action Plan 2019-2020, pegged the demand stuck in appeals at Rs. 5.71 lakh crores, of which Rs. 1.15 lakh cores was stayed by the Tribunals or Courts. Income-tax appeal process in India, from Commissioner Appeals to the Supreme Court, is lengthy and a costly one, where the average time to finally resolve a dispute is not less than 15 years. Thus, there can be no doubt that there is a dire need for modern and effective alternate dispute resolution mechanisms.

The current forms of alternate dispute resolution mechanisms available in India have limited utility. There is strict compartmentalisation, which does not provide businesses the clarity they would desire. For example, the Advance Pricing Agreement program is not clear on permanent establishment exposure or even its attribution, while the Authority for Advance Ruling does not venture in to determine fair market value of taxable transactions. Theoretically, one may approach both these forums to have overall clarity, but all alternate dispute resolution mechanisms available in India have their limitations:

1. Authority for Advance Ruling - Though once very popular, the authority has now lost momentum. The promise of ruling in a six-month period has not been fulfilled by the government. Further, pronouncement of inconsistent rulings has made taxpayers averse to this forum.

2. Advance Pricing Agreements - This mechanism has been largely successful. However the pace at which agreements are finalised needs improvement, owing to the shortage of resources available to this forum.

3. Mutual Agreement Procedure - There is no certainty here that the dispute may be resolved. Further, the taxpayer cannot control the outcome, as it is not directly involved in negotiations.

4. Dispute Resolution Panel - Lack of appeal by the department, has made this forum only a fast track route to the Tribunal.

5. Settlement Commission - This option is available to a taxpayer only once in a lifetime.

It is about serious time that the government started bringing in measures to curb and reduce litigation. As per recent informal interactions and media reports, it is widely expected that the government is contemplating to bring in “MEDIATION” as a mechanism to resolve tax disputes. Based on international statistics, this mechanism seems to be an effective alternative to the lengthy and costly process of appeals.

If one were to simply put it, Mediation is a voluntary non-binding process, wherein each party retains 100 percent control over whether to settle the case or not. No one, including the mediator, can force either party to do something, which they do not agree to. Hence, mediation is successful only when both parties have the desire to resolve the dispute.

B. Global success ratios on Mediation vs litigation

Clarity on taxation may be one of the strongest motivations for businesses to resolve disputes through mediation. On the other hand, the tax department may also be on better footing if they resolved their disputes through mediation, as their success rate in litigation is not very good. As per the 2018 Economic Survey of India, the tax department's success rate before the ITAT/CESTAT was 27 percent, before the High Court was 13 percent and before the Supreme Court it was 27 percent. Now compare this with HMRC - its success rate before Tribunal is more than 75 percent, with High Court it is 88 percent, 74 percent at Court of Appeal and 100 percent with the Supreme Court (as per the annual report published by HMRC for 2018-19). Despite such high success rates, HMRC has a successful mediation programme. As per HMRC's Annual Report for 2018-19 a whopping 88 percent of the cases accepted for mediation, were resolved. As per the data published by the Australian Tax Authority, they were able to recover more taxes when they settled the disputes in the early stages of litigation:

|

Stage |

Settlement Cases |

% of total settlement |

ATO position |

Settled position |

Variance |

|

|

$m |

$m |

$m |

% |

|||

Pre-audit |

211 |

33% |

329.5 |

250.5 |

79 |

24% |

Audit |

206 |

32% |

3,147 |

1,694 |

1,453 |

46% |

Objection |

115 |

18% |

370 |

184 |

186 |

50% |

AAT |

92 |

15% |

32 |

16 |

16 |

51% |

Federal Court |

11 |

2% |

49 |

16 |

333 |

67% |

High Court |

0 |

0% |

0 |

0 |

0 |

0% |

In the United States, the IRS has introduced various options for taxpayers such as Fast Track Settlement, Fast Track Mediation and Post-Appeals Mediation, which is only indicative of the success of such ADR mechanisms there. Hence, it may definitely be worthwhile for the Indian government to provide a meaningful mediation process, for amicably settling tax disputes.

C. Critical factors for a Mediation program:

Some of the factors that may be kept in mind while designing this option are discussed hereunder:

Mediation is facilitative

It is facilitative in nature in that the parties want to arrive at a resolution, which is voluntarily acceptable to them, as against the traditional approach of outsourcing the responsibility to a judge or an arbitrator etc. With the help of a mediator, parties can communicate more efficiently. Hence the mediator ought to be a person who understands both perspectives, the taxpayer's as well as that of the tax department's. Hence, it may be useful if the mediator is not an officer of the tax department but a neutral person so as to effectively communicate with both parties. If this is not possible then designated persons earmarked to be mediators from the government, should be appraised with parameters of cases resolved rather than tax collected and such data should be shared transparently with all taxpayers.

Self-determination

As per the Model Standards of Conduct for mediators published by the American Bar Association:

“A mediator shall conduct a mediation based on the principle of party self-determination. Self-determination is the act of coming to a voluntary, uncoerced decision in which each party makes free and informed choices as to process and outcome. Parties may exercise self-determination at any stage of a mediation, including mediator selection, process design, participation in or withdrawal from the process, and outcomes.”

Hence, for a mediation process to be successful, the government is required to include in its policy, the appropriate authority for the tax department to settle disputes, which should also include a mechanism to protect the autonomy of the officers who are involved in offering a settlement package. It is seen that though rulings of Authority for Advance Rulings / Settlement Commission are binding on the tax department, they are challenged by the Assessing Officers, before the High Court, by invoking constitutional provisions. The tax department, internally, needs to be on the same page. This aspect is very important in order to abide by the principle of 'self-determination' which is one of the pillars of mediation.

Underlying Interests

Mediation is successful when parties are clear on their underlying interests. Explaining this with an example, while executing the Mumbai Metro project, tunnels are to be made within 4 years. There is a 'tunnel boring machine' which is specifically designed for each tunnel. Once a tunnel is completed, the machine can be only sold for its scrap value. The taxpayer would want to treat the cost of the 'tunnel boring machine' as revenue in nature, given the limited life it has. Against this, the current provisions of the Act, would classify such purchase as a plant eligible for depreciation at the rate of 15 percent. Effectively in 4 years only 52 percent of the cost shall be allowed a deduction, with the rest value being treated as a short term capital loss, which may be useless for the taxpayer in the absence of short term gain, which is often the case.