Experts' Corner

Building Trust – Organisation’s Key Enabler in the Sustainability Journey

(With contributions from team members Ishita Bhartia and Prachi Majumdar)

As the global community grapples with issues of rapid urbanisation, resource constraints, climate change, the COVID-19 pandemic and more, sustainability is no longer just a topic of hypothetical consideration, but a necessity for the sustenance of the human race on planet Earth. It is imperative that sustainability be practiced by everyone today - as an individual, a community, a country or an organisation. Several decades back, the ‘polluter pays principle’ emphasised the responsibility of companies or communities to compensate for the environmental degradation resulting from the unrelenting pursuit of economic growth without due care for sustainability.

Climate crisis is among the top sustainability issues in current times. With the Paris Agreement of 2015 and the Conference of Parties’ (COP) broader agenda, the onus falls upon not just the governments of the nations, but also on the private and public entities to work towards a sustainable future for all. As organisations pursue their sustainability journey, trust-building has become a critical component. Whether it is top organisations being accused of greenwashing or critique on emissions data at a city or country level, the credibility of a sustainability journey is indeed important. In order to limit global warming to 1.5 degrees Celsius, which is believed to be a reasonable and optimal trade-off between prosperity and sustenance, the sustainability actions of every organisation need to be earnest. Simultaneously, it is of immense importance for an organisation to win the trust of its multiple and diverse stakeholders, who often have conflicting expectations. Trust building is therefore not just important to an organisation’s sustainability journey, but is an integral component.

Trusted partner in sustainable development

The sustainability crisis crosses boundaries of race, culture and region. A climate disaster in one country can lead to disruptions in the value chain of an organisation located in a different region. For example, the 2011 Tohuku earthquake and tsunami in Japan, led to disruptions in the supply chain of automobile manufacturers not only in Japan but worldwide. Such global disruptions are becoming more and more commonplace due to the increased frequency of climate-related disasters. An organisation’s sustainability journey, which focuses not just on mitigation, but also adaptation, helps in minimising the impact in such situations, continues value creation in adverse situations, and in turn, aides in developing confidence amongst stakeholders.

The key ingredient of trust is to seek multi-stakeholder (employees, investors, supply chain, customers, etc.) inputs in developing ESG-related strategies, that ensure its own system of checks and balances. Such sustainability strategies not only meet the need of a diverse set of stakeholders but also manages organisations’ risks most effectively and creates opportunities for the organisation in the long term. And such trust empowers the organisational leaders to ensure the embedding of sustainability considerations in decision-making processes across functions.

The Environment, Social, Governance (ESG) approach to sustainability promotes behavioral change not just within the organisation, but also across its entire value chain. This sequentially contributes towards change on a larger scale, across industry sectors as well as regional levels eventually contributing towards a global sustainability agenda. Going beyond the regulatory requirements, such actions build up trust and confidence among the stakeholder groups, including the investors. Aligning organisational sustainability goals with that of region or nation effectively ensures that the company’s efforts are not in a silo, but rather in sync with the bigger picture of transformational shift. In recent times, we see multiple instances where organisations disclose their attempt at such alignments of endeavours, strategies, targets and contributions towards the Global Goals, i.e. the UN Sustainable Development Goals (SDGs).

With the growing global concern over climate change, as well as countries striving for green recovery post the pandemic, consumer awareness is at an all-time high. As organisations aggressively push forth the sustainability agenda within their respective development strategies, building the trust of such customers is important like never before. ESG targets play a critical role in developing consumer trust, as they act as a yardstick against which progress can be measured. On climate action, for instance, an effective way of target setting is through alignment with global initiatives and institutions such as the Science Based Targets initiative (SBTi). For example, a prominent German automobile manufacturer has set a target of an 80% reduction of Scope 1 and 2 emissions per automobile in its manufacturing process, from its 2019 levels by 2030. Organisations can also align their targets with sectoral targets, such as the Net-Zero target for the cement and concrete sector by the Global Cement and Concrete Association (GCCA). Such an alignment gives a scientific foundation to the targets, as well as aligns them with similar organisations in the sector across the globe.

Increased transparency through quality sustainability disclosure

Along with setting targets and aligning with relevant local and global institutions, sustainability disclosures are an effective way of trust building for an organisation. For several decades, since GRI and other sustainability disclosure frameworks have gradually taken shape, there has been a rapid rise of voluntary disclosures across the world and India has been no exception. Such disclosures effectively bring out the non-financial performance of a company, which supplements the financial performance that typically is disclosed to the shareholders and regulators.

Capital markets all over the world consistently recognise the value of sustainability or ESG disclosures in pursuance of responsible investment. Such recognition has gradually motivated companies to participate in disclosures across multiple platforms. For instance, disclosing carbon emissions and water at Carbon Disclosure Project (CDP) or responding to sustainability indices, such as DJSI, MSCI and others. On many occasions, non-disclosure or inappropriate disclosure fail to attract investment for business growth due to a lack of investor trust. Such disclosures, though still voluntary, are therefore becoming a compulsion for organisations in some way.

In addition to this, non-financial disclosure is also driven by regulation in many regions or countries. A recent example is a requirement of BRSR (Business Responsibility & Sustainability Reporting), mandated in India from reporting cycle FY22-2023 for the top 1,000 Indian companies by market cap. It is encouraging to see that BRSR draws elements from multiple global frameworks and standards, that not only encourage companies to disclose based on materiality, buts also provide nudges for acting on appropriate climate action as well as considering ESG in the value chain.

In the US and Europe, in recognition of the growing share of climate concerns among sustainability issues, regulatory directives on corporations for more climate-related disclosure are under active consideration, which is expected to inevitably influence the disclosure requirements in regions where the value chains of these companies are extended.

The sustainability disclosure practice can be seen as a loop between the public mandates and regulatory frameworks, the business of the organisation itself and society. All these factors influence each other and hence keep this loop moving and evolving. The BRSR from the Securities and Exchange Board of India (SEBI) in India is one example of a new framework. The recent setting up of the International Sustainability Standards Board (ISSB) under the IFRS Foundation is an example of an attempt towards integration of multiple frameworks of sustainability disclosure.

The sustainability disclosure landscape is dynamic and fast-moving. While this helps in the transition to an increased degree of robustness over time, sometimes it leads to a sense of overwhelm for organisations on their sustainability journey. Organisations tend to face a capacity crunch either in terms of knowledge or technical skills in producing high-quality disclosures, building internal capacity and working closely with sectoral peers - locally and globally, through aligning knowledge, skill and capacity resources which can all help build an effective ecosystem for sustainability disclosures at a sectoral level.

Enhancing trust and confidence in sustainability information

Sustainability targets and disclosures are critical for trust building. The credibility of the same tends to contribute significantly towards validating an organisation’s sustainability progress. Assurance, both internal and external, are an effective way of enhancing the credibility of an organisation’s sustainability information. Sustainability reporting frameworks such as GRI, also lay emphasis on the need for assurance, especially third-party assurance for the information being disclosed by the organisation. Over years, several standards are used by professionals for the assurance of non-financial information, ISAE3000 and AA1000AS being the most adopted globally as well as in India.

The legitimacy of sustainability data adds more credibility to an organisation’s performance when its impact is visible across the different facets of the business.

The emphasis on Integrated Reporting is gaining strength over the years; this is an attempt being made to address the intertwined nature of the financial and non-financial performance of a company in creating enterprise value, further enhancing trust building.

End note

An organisation’s sustainability journey cannot be de-linked from the core strategy of its business. Managing risk and leveraging on opportunities need to be looked at from both a financial and non-financial perspective in an integrated manner. The viability of a business model needs to be assessed by its sustainability impact along with the economic and financial impacts.

As organisations take their sustainability journey forward and work towards inspiring trust amongst their stakeholders in their ESG endeavors, professionals and experts from multiple disciplines, such as process & technology, finance, accounting, business management and sustainability, play an important role to ensure that sustainability becomes an integral part on an organisation’s business imperative. The ability to interpret the interplay between sustainability actions and business performance is becoming one of the fastest key business priorities, and the collaborations between accounting professionals with business leaders and ESG practitioners will facilitate an organisation’s business success in a significant way.

[Views expressed are personal]

ESG & Sustainability Accounting Standards - A Primer

In 2015, countries reached an agreement (“the Paris Agreement”) to mandate companies to include climate related financial disclosures. Globally, companies are striving to increase transparency in their ESG (Environment, Social, Governance) & sustainability disclosures and provide insight into their compliance with the Paris Agreement.

Investors as well are gravitating towards sustainability & ESG focused companies and seek actionable information about the sustainability measures taken by them. Thus, sustainability disclosures are now becoming essential to a company’s operational and financial performance. The rising importance is spurring the shift towards better reporting practices and standardization. As per the Governance & Accountability Institute, 90% of S&P 500 companies published sustainability reports in 2019. Also, a recent study by the US SIF (The Forum for Sustainable and Responsible Investment) reported a 42% increase in sustainable investing strategies from $12 trillion in 2018 to $17 trillion in 2020.

The momentum for ESG and sustainability investing is set to continue to grow, with another $20 trillion expected to go into ESG funds over the next two decades, according to Bank of America.

To facilitate companies in generating reliable, transparent performance, the Sustainability Accounting Standards Board (SASB) provides data standards and reporting frameworks as a step toward resolving the sustainability reporting issue.

A. Sustainability Accounting Standards Board and its Standards

Founded in 2011, SASB (www.sasb.org) is one of the most used frameworks and standard setting agencies followed by Global Reporting Initiative (GRI) Standards and Task Force on Climate-Related Financial Disclosures (TCFD) Recommendations.

Currently, it is managed by the Value Reporting Foundation (VRF). SASB develops and publishes accounting standards for financially material sustainability issues. These standards are sector-specific and created for investors who require sustainability related information that impacts a company's valuation.

The concept of sustainable investment is becoming increasingly popular among investors. By harmonizing reporting standards, SASB is not only able to address the proliferation of disclosure frameworks, but also to provide more consistent comparisons between sustainable investments.

These standards enable businesses to report on impacts on the environment, social capital, human capital, business model, innovation, and leadership and governance from a financially material point of view. Over 1300 companies worldwide use SASB standards to report on all three ESG pillars.

Illustration 1: Table - Disclosures of sustainability issues under SASB materiality map

|

Environment |

Leadership and Governance |

Business model & Innovation |

Social capital |

Human capital |

|

GHG Emissions |

Business ethics |

Product design & lifecycle management |

Human rights & community relations |

Labor practices |

|

Air Quality |

Competitive behavior |

Business model resilience |

Customer privacy |

Employee health & safety |

|

Energy Management |

Management of the legal & regulatory environment |

Supply chain management |

Data security |

Employee engagement, diversity & inclusion |

|

Waste and wastewater management |

Critical incident risk management |

Materials sourcing & efficiency |

Access & affordability |

|

|

Waste and hazardous materials management |

Systematic risk management |

Physical impacts of climate change |

Product quality & safety |

|

|

Ecological impacts |

|

|

Customer welfare |

|

|

|

|

|

Selling practices & product labeling |

|

B. Growing prevalence of SASB

As the threat of climate change looms, it becomes even more critical for companies, investors, and regulators to spearhead ESG activism. This gives more weightage to companies which are ESG compliant and report comprehensive disclosures on sustainability.

As per the analysis of Center for Audit Quality (CAQ) on the annual ESG reports published by S&P 500 companies, third-party assurance or verification was received by over 60% of S&P 500 companies that issued an ESG report disclosing the data in their reports.

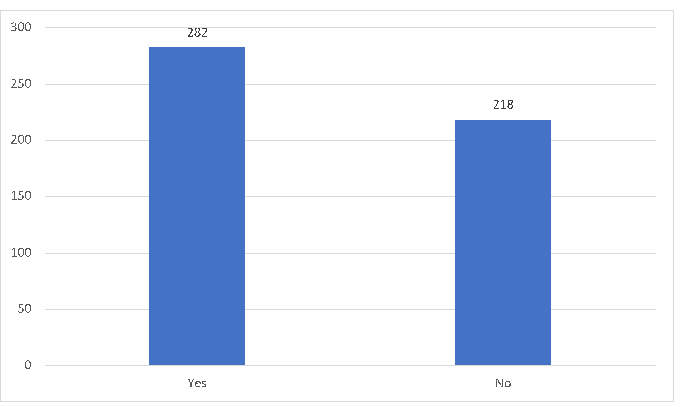

Illustration 2: Chart – Acquired Assurance or Verification

In light of the growing demand for assurance from regulators and others, this number is likely to continue to grow. The analysis also found that the percentage of accounting firms engaged in assurance increased to 15%.

C. Conclusion

As investors become aware of the correlation between long-term profitability and corporate transparency. It is the responsibility of companies to provide investors with information that will influence their investment decisions. Information related to sustainability is included in this.

The SASB standards can be useful for any organization that wants to report on sustainability in detail. In addition, these standards can be used to develop sustainability strategies for the company around the most critical issues in industry. Additionally, these standards help raise the value of sustainability for both corporations and investors, as well as supporting consumer needs and global sustainability goals.

Growth Enterprises – Leveraging Available Technologies to Support Growth

India is one of the fastest-growing economies globally, and the MSME (Micro, small & medium enterprises) sector with is growth in double digits is a key driver of this progress. The unparalleled entrepreneurial abilities of the founders/promoters supported by the ‘Make in India’ and other government initiatives are key enablers for the quick growth of this sector.

MSMEs traditionally rely more on people than processes or technology and hence, as their operations expand, they begin to face newer challenges around operational visibility, controls, regulations, quality, etc. With the operational overheads increasing, they start to take attention away from the growth strategy. A timely transition from people-centric structures to process & technology-led organisations, could result in saving operational overheads. Operating model changes, a strong controls framework and an integrated technology backbone can help stay focused on the growth journey and build a robust foundation to transition into a large enterprise.

Operating Model Evolution: From centralised founder-driven decision-making to decentralised business heads-driven decision-making, the process requires fundamental changes in the ways of working. The firms need to hire diversified talent, empower them with the right support and provide a collaborative framework for different departments to work together in alignment with the overall business vision. Organisations need to find ways to reduce bottlenecks, from founders’ availability of time, availability of credit, the availability of resources and so on. Industry benchmarking can help identify the right operating model for the firm, a progressive organisation structure can enable employees to exceed their KPIs and an agile and collaborative way of working can help bring internal and external partners together for improved productivity.

Process Standardisation: As businesses scale, the leadership team requires standardised processes in place to ensure the smooth functioning of the business while having control over operations. The standard processes like order to cash, procure to pay, record to report, etc. help create end-to-end visibility into an organisation’s operations and also help standardise controls (e.g. credit limits, approval authority, 4 eye checks, etc.) across the process life-cycle. Process standardisation creates a business rules-driven environment, takes subjectivity out of decisioning processes and sets up the stage for automated operations and control.

Technology Adoption: An integrated technology backbone is imperative to support standardised processes and controls. Technology must be looked at as an enabler and not as a cost. An early investment in a robust ERP solution can help improve efficiency, reduce cost, provide visibility and confidence in data and most importantly, free leadership time from transactional activities to pursue strategic initiatives. Cloud-based ERP platforms have reduced the cost of ownership tremendously and can now be adopted by MSMEs rather easily. The capabilities of these cloud platforms are continuously evolving with the addition of business-specific templates, location taxation support, standard reporting, detailed analytics, etc.

As the scale of operations grows, customer segments and competitors also evolve. The data from an integrated ERP platform can provide intelligent insights for the leadership team to understand the strengths of the operations, find bottlenecks and leverage the broader partner/industry ecosystem better, with very specific asks. The data can further support predictive and prescriptive analytics by leveraging the latest AI/ML tools.

Overall, there is a strong case for adopting an integrated ERP platform for continuous growth and an early adoption can help organisations in addressing newer opportunities with more objectivity and confidence.

Role of International Standard Setter - AOSSG!

During the period in 2007-08, many jurisdictions in the Asian-Oceanian region had adopted or converged with the International Financial Reporting Standards (IFRSs) while many others had announced convergence with the IFRSs with time-tables or roadmaps. In the context of increasingly globalised financial reporting standards, it was necessary for the Accounting Standard-Setters in the region to establish a platform to discuss problems, issues and share experiences in the convergence process and make contribution to a single set of high-quality

global accounting standards. Accordingly, Asian-Oceanian Standard-Setters Group (AOSSG) was established in 2009. The Institute of Chartered Accountants of India (ICAI) is a founder member of the Group.

In November 2009, during the first Annual Meeting of AOSSG held in Malaysia, the Memorandum of Association (MoA) was signed by 16 jurisdictional Accounting National Standard-Setters requested to be a part of the Group. Over the period of 10 years since the formation of the Group, more members joined hands and currently, the Group has 27 members i.e., jurisdictional National Standard-Setters contributing to the work of AOSSG. The AOSSG plays a significant role in increasing the region's adoption of IFRSs.

THE OBJECTIVES OF THE AOSSG ARE:

- Enhancing the standard-setting and financial reporting technical capabilities of national accounting standard setters in the region

- Contributing to the development and consistent application of IFRS Standards and addressing financial reporting issues of concern to the region

The activities of AOSSG are managed by Chair with the assistance of the Chair’s Advisory Committee (CAC). Currently, the CAC of AOSSG comprises of 10 member jurisdictions viz. Australia, China, Hong Kong, India, Japan, Korea, Malaysia, Pakistan, Singapore and Sri Lanka and is responsible for supporting the Chair and Vice-Chair in performing their functions.

Working Groups have been established to help manage AOSSG‘s contributions to the International Accounting Standards Board (IASB) . The Chair monitors progress/functions of the Working Groups and serves as a liaison with other organisations, governments, and regulators in the region and in the world for the purpose of learning other stakeholders‘ circumstances and advancing the interests of the AOSSG.

ICAI AND AOSSG

India is represented by the Institute of Chartered Accountants of India (ICAI), as a founder member of AOSSG. ICAI, through its nomination by the then Council, CA. (Dr.) S. B. Zaware, held the position of Vice-Chair, AOSSG for a period of 2 years 2017-2019, followed by Chairmanship of 2 years (2019-2021). ICAI continues to contribute to the activities of AOSSG as a member of Chair’s Advisory Committee (CAC).

IFRS IN BRIEF

The IFRS Foundation is a not-for-profit, public interest organisation established to develop high-quality, understandable, enforceable and globally accepted accounting and sustainability disclosure standards—IFRS Standards—and to promote and facilitate adoption of the standards.

IFRS Standards are developed by two standard-setting boards, the International Accounting Standards Board (IASB) and the newly created International Sustainability Standards Board (ISSB). The IASB sets IFRS Accounting Standards and the ISSB sets IFRS Sustainability Disclosure Standards.

IFRS Accounting Standards set out how a company prepares its financial statements. IFRS Sustainability Disclosure Standards set out how a company discloses information about sustainability-related factors that may help or hinder a company in creating value.

IFRS STANDARD-SETTING PROCESS

The IASB follow a thorough, transparent, and participatory due process while issuing an IFRS Standard or an IFRIC Interpretation. If the IASB decides to amend a Standard or issue a new one, they generally review the research, including comments on the discussion paper, and propose amendments or Standards to resolve issues identified through research and consultation. Proposals for a new Standard or an amendment to a Standard are published in an exposure draft for public consultation. To gather additional evidence, members of the IASB and IFRS Foundation technical staff consult with a range of stakeholders from all over the world. The IASB analyses feedback and refines proposals before the new Standard, or an amendment to a Standard, is issued.

HOW AOSSG HELPS IN IFRS STANDARD-SETTING PROCESS

AOSSG is a spokesman with IASB and IFRS Foundation for IFRSs on behalf of AO Jurisdictions and it plays a key role in promoting the adoption/ convergence with, IFRSs by jurisdictions in the region. This designates that the role of AOSSG is important in the overall mission of IFRS Foundation.

The International Financial Reporting Standards (IFRSs) are increasingly accepted in this region, and many Asia-Oceania jurisdictions have either adopted IFRSs or are considering adoption of IFRSs or making progress towards convergence with the IFRSs. The AOSSG was established to help:

a) coordinate the efforts of stakeholders in the Asia-Oceania region in global standard-setting;

b) maintain the momentum towards global standards; and

c) support the credibility and responsiveness of the IASB.

As a group of organisations with expert knowledge of standards and in-depth understanding of issues in the region, the AOSSG works towards achieving the defined objectives in coordination with its members by:

a) taking a leadership role in global accounting standard setting;

b) conducting proactive research and thought-leadership activities;

c) promoting regional initiatives regarding consistent application;

d) providing other relevant assistance to the IASB;

e) providing advice and consulting with member jurisdictions.

Conducting these activities helps in creating a beneficial cycle of:

(a) deepening ties between stakeholders in the region and the IASB;

(b) enhancing regional engagement in the international standard setting process; and

(c) encouraging the consistent application of IFRS Standards in the region

AOSSG is also contemplating to include the IFRS Sustainability Disclosure Standards in the AOSSG scope through a working group mechanism as a temporary measure.

ICAI’S EXPOSURE, EXPERIENCE, AND ACHIEVEMENTS AS AOSSG CHAIR

Recognizing the objectives of AOSSG and advancing the mission of ICAI in this age of globalisation, ICAI, as AOSSG Chair, undertook the following activities:

(1) Submitting Regional Views to the IASB and the IFRS Foundation

While commenting on IASB documents, AOSSG‘s views reflect the collective views AOSSG members without interfering with the authority of member standard-setters regarding whether and how to apply the standards proposed or published by the IASB. If AOSSG members holds differing views, those differing views are reflected within AOSSG comment letters. Individual member standard-setters may also choose to make separate

submissions from their jurisdiction that are consistent or otherwise with aspects of the AOSSG comments. The intention of the AOSSG is to enhance the input to the IASB from the AO region and not to prevent the IASB from receiving the variety of views that individual member standard-setters may hold.

During ICAI’s term as Chair, AOSSG has actively submitted comments to all significant IASB discussion papers, exposure drafts and other consultative documents. While submitting the comments to IASB on behalf of AOSSG, the WGs leaders collate the views of the AOSSG members, the Group submitted its comments on the IASB’s Exposure Draft including:

- IASB Exposure Draft General Presentation and Disclosures (ED/2019/7) in September 2020

- IASB Discussion Paper Business Combinations—Disclosures, Goodwill and Impairment in December 2020

- IASB Request for Information Comprehensive Review of the IFRS for SMEs Standard

Complete details could be obtained at https://aossg.org/submissions-and-publications/submissions-to-iasb

(2) AOSSG’s participation in Accounting Standards Advisory Forum (ASAF)

The objective of ASAF is to provide an advisory forum in which members can constructively contribute towards the achievement of the IASB’s goal of developing globally accepted high-quality accounting standards .AOSSG has also been a nominated member of the ASAF and is represented by the Chair, AOSSG and Working Group

Leaders. During ICAI’s term as Chair, the Working Group leaders of AOSSG collated members’ comments for all the ASAF meetings and presented the regional view at ASAF meetings.

(3) AOSSG meetings and Education Sessions

With the outbreak of the Covid-19 pandemic, face-to-face meetings were not scheduled in 2020 and 2021. However, this did not stop the spirit of AOSSG, all AOSSG meetings (including CAC, Interim, WG and Annual meetings) and educational sessions were held virtually.

- During the 2021 AOSSG Annual Meeting in November, the ASBJ (Japan) as the working group leader of Business Groups and Assets in coordination with the IASB conducted an outreach session on Discussion Paper - Business Combinations—Disclosures, Goodwill and Impairment

- During the September 2021 AOSSG Interim meeting, upon Secretariat’s request, IASB, conducted two educational sessions for AOSSG members on:

- Classification of Debt with Covenants as Current or Non-current

- Supplier Finance Arrangements

(4) Research Activities

The WGs of AOSSG take proactive steps to undertake research and publish its findings. AOSSG Working Group was held in November 2020, wherein, ICAI presented findings on Preliminary Research on “Financial Ratios”. Preliminary research was conducted encompassing presentation of selected ratios across six AO jurisdictions viz: Australia, China, India, Sri Lanka, Malaysia and Japan. The purpose of presentation was to seek opinion of AOSSG members on the project and to provide inputs to IASB for

standardisation of financial ratios.

(5) Amendment and upgrade of AOSSG Formal Documents

In the interest of the Group, it was important to amend official documents of the AOSSG.

ICAI undertook the activity of revisiting all the formal AOSSG documents viz.

- MoU & Annexures to the MoU

- Vision Document

- Membership Due Process

- Working Group Modus operandi

- AOSSG Protocol for raising emerging issues

- AOSSG Protocol for responding to Technical Requests

These amendments were much needed and smoothly undertaken. The efforts of ICAI in this regard were much appreciated by the AOSSG members.

(6) Redesigning and Refurbishment of the AOSSG website

Post taking over as Chair, AOSSG, Dr. S. B. Zaware, with the objective of making the AOSSG website more beneficial, in consultation with the CAC meeting decided to takeover the task of redesigning and refurbishment of the website along with its regular maintenance for the Chair’s tenure.

The website was upgraded taking into consideration various factors such as clear site architecture and navigation, visual appeal, comprehensive content, and mobile compatibility. Further new features/tabs have been introduced on the AOSSG website, for instance, login facility for CAC members, details on the background & history of AOSSG, information on all the AOSSG meetings and events and photo gallery.

CONCLUSION

Our Hon’ble Prime Minister Shri Narendra Modi had said “We know that we will be more successful when we pursue our goals in partnership with the world”. We, at ICAI believe, this is complete synergy with our vision of becoming the world's premier accounting body and develop global professionals. In this regard, ICAI continues to liaison with standard-setters across the globe and considers it crucial to promote the nation’s interest in the international affairs. Apart from AOSSG, ICAI actively participates in the discussion meetings organised by

the World Standard-setters (WSS), International Forum of Accounting Standard Setters (IFASS), Emerging Economies Group (EEG) & other such forums and present its views and issues from time to time at these forums. These forums have also provided us valuable insights on experience of implementation of IFRS in various jurisdictions.

Data-driven & Future-ready Accounting Practices

Business digitalization is the use of digital technologies to change a business model and enhance the value. Recent surge in accessibility of data has led to rapid advancements in digital technologies, which are transforming economies, societies, and businesses.

A digital revolution, which is still unfolding before our eyes, has changed the nature of accounting work as well. Automation and robotization of routine accounting processes, the introduction of business intelligence, and the application of data analytics are among the results of digitalization in the accounting function.

Leaders of accounting firms look at two aspects of the business when considering the future of accountancy firms - service delivery and practice management.

- Service Delivery

It is critical to the success of accounting firms to deliver efficient services to their clients. For which they need a trained and well-managed workforce that provides these services.

Millennials and Gen-Z personnel are not very keen on performing redundant tasks such as preparing tax returns for the same clients or performing audit procedures year on year. This poses a challenge of recruiting and retaining the right talent in service delivery, especially for smaller and medium-sized accounting firms.

Increasing efficiency is the key to profitability for accounting firms. However, if the same people do not want to do the same job, management will be in conflict, on one hand expected to stay competitive and on the other hand foregoing efficiency.

Data analytics and automation can be the ideal solution for this. As an added advantage, the technical skills of accountants make working with descriptive analytics, predictive analytics, and prescriptive analytics easier.

Logic-based, repetitive tasks such as creating worksheets can be automated. In this way, employees are liberated from the monotony of repetitive work and can step-up their efficiency in interpretation of data, tax and regulatory law and application of accounting & auditing standards.

Amidst the constant evolution of the business domain, tax laws and accounting standards continue to evolve as well. The accountants who enhance their efficiencies through data analytics will be better prepared for the future than their peers.

- Practice Management

i. Efficiency optimization

Accounting firms, like many businesses, are riding the digitization wave to improve their day-to-day functioning and increase their efficiency. By deploying data analytics, which can perform linear and predefined tasks on huge data sets to capture information from different systems such as accounting, time and billing, CRM, scheduling, etc., huge amount of valuable working hours can be saved and utilized for more productive and value-added tasks. This dramatically improves the overall efficiency.

As an example, RPA (Robotic process automation) can be used as a service delivery tool to automate tasks such as filling out tax forms, conducting audit procedures, conducting transfer pricing economic analyses, etc., as well as preparing VAT or sales tax returns by collecting information and populating standardized forms on a monthly basis.

ii. Sector-specific support

By increasing the efficiency of information management across systems, firm management can better manage organic growth. Growth in accountancy practices, however, is often inorganic. As firms acquire other firms, they inherit and accumulate disparate information systems. In this scenario, digitization can make a huge difference. While the merged or acquired firms try to get on the same platform, work doesn't have to halt. Through digitization, separate offices and separate businesses can continue to operate using legacy processes, and still receive all of the information needed at the management level.

iii. Ease out deadline pressure

Financial processes in businesses have predetermined timelines, such as tax filing deadlines and financial statements submission deadlines. Accountancy firms, be it in audit, tax, or consulting, face the greater pressure of the calendar, with tight deadlines to compile and process information. This pressure can be alleviated by automating processes, as well as improving data quality and speeding up delivery to meet crucial deadlines. It can also reduce the cost of hiring seasonal workers who are added to the payroll to manage the load during peak seasons.

Clearly, accounting firms must adopt digital technologies to manage their operations and better serve their customers. The use of data and technology together with human judgment and business acumen seem to be the key to future success.

Accounting Standards for Resurgent New India

(This article has been co-authored by CA. Kali Charan Sharma)

Recent History:

The ICAI, in its endeavour to enable the Nation with high quality accounting standards comparable to the best in the world, decided in the year 2006 to converge with International Financial Reporting Standards (IFRS) issued by the IASB, which were being recognized as Global Financial Reporting Standards. This accounting reforms initiative of ICAI was endorsed by the Government of India with international commitment made by the then Hon’ble Prime Minister in 2009 at the G20 Summit.

In the year 2011, the core committee of MCA had requested ICAI to examine whether there should be one set or two sets of Accounting Standards and whether one set of Accounting Standards can be applied for all companies including one person companies and small companies.

The ICAI, after an in-depth examination and study, recommended that there should be two sets of Accounting Standards - one set comprising Ind AS for large, public interest companies and the other set containing simplified measurement principles with fewer disclosure for small companies. It was also mentioned that a second set of standards does not mean that the recognition and measurement principles would be significantly different from Ind AS in cases.

Against this backdrop, based on the broader theme - ‘Building Trust Enabling Sustainability’ of the ‘21st World Congress of Accountants’ to be held in November 2022, Taxsutra Greentick brings to you an incisive article-series titled ‘Compliance: A Collective Responsibility’ which emphasizes upon India’s redefined regulatory framework, viz. how different oversight bodies perform their regulatory roles in India w.r.t accounting, reporting and auditing; major non-compliances pin-pointed by them; expectations of investors/ stakeholders and the need for quality reporting.

Roadmap:

In 2020, the ICAI released an approach paper titled “Accounting standards for resurgent new India of 2020’s” regarding revision of existing accounting standards. The ICAI mentioned the following reasons to introduce new ASs in its approach paper:

- During the deliberations on the Ind AS Roadmap at MCA Core Group in 2010 and 2013-14 and subsequent discussions on draft Ind ASs, some members were of the view that there should be one set of standards applicable to all companies namely Ind AS. Some Regulators expressed the view that recognition and measurement principles should be by and large similar for all companies and some felt the need for simpler accounting standards for smaller companies. Therefore, ICAI was asked to study whether 'one set of Accounting Standards' can be applied to all companies including one person companies and small companies as defined in the Companies Act, 2013. The ICAI was requested to study the option of "second set of Accounting Standards' as to how it would be consistent with the first set of Accounting Standards so that at least the recognition and to a large extent the measurement principles are the same. The ICAI in its report on Impact Analysis of Indian Accounting Standards and One set of Standards vs. Two sets of Standards dated October 21, 2013 recommended 'two sets of Accountings Standards' and the second set of Accounting Standards may comprise the revised existing Accounting Standards for small and one person companies.

- Other factors that necessitated the need for the revision of the existing ASs:

- Structure, Layout and Text of ASs lack consistency and uniformity

- Concepts and Approaches are outdated

- Language has potential for serious misapplication and misunderstanding about the ASs

- Lack of comprehensive robust principles and inadequate guidance in certain areas

The approved approach paper of NACAS can be summarised in following 4 categories –

|

Category of AS |

Methodology of ASs upgrade approach |

|

Category 1 |

Ind AS corresponding to which AS need not be issued. |

|

Category 2 |

Existing AS to be revised by including certain aspects from the corresponding Ind AS |

|

Category 3 |

Ind AS can be used as basis for revision of the corresponding existing Accounting Standards with changes as suggested in the Approach Paper finalized |

|

Category 4 |

Standards for which hybrid approach to be followed (consolidation and financial instruments related Accounting Standards) |

While NFRA, on 28 September 2021, returned the approach paper submitted by ICAI for further analysis of various other factors, ICAI is in discussions with NFRA to conclude on this matter. Until 2021, the ICAI had submitted 18 Revised Accounting Standards to the NFRA. Further, many more revised accounting standards have been exposed to public for comments.

Benefits of Second set of Accounting Standard:

- Simplified measurement principles with fewer disclosures for smaller companies.

- Standardisation of alternate accounting treatments - The Accounting Standards reduce to a reasonable extent or eliminate altogether confusing variations in the accounting treatment followed for the purpose of preparation of financial statements.

- Requirements for additional disclosures - Standards may call for disclosure beyond that required by law.

- Comparability of financial statements – The standardisation of accounting procedure improves comparability of financial statements.

- Reduction the scope of creative accounting – The creative accounting refers to twisting of accounting policies to produce financial statements favourable to a particular interested group.

- Improving credibility of Accounting Data and quality of the financial reporting.

- The appropriate balance between fair presentation and prudence should be maintained.

Approach for Disclosure requirements:

The disclosures requirements in various accounting standards should be reduced keeping in view the level of entities based on the followings:

- In respect of formulation of the standards for which existing Accounting Standards is currently available, the disclosure requirements should be broadly as per the existing Accounting Standards including exemptions/relaxations given to SMEs.

- The disclosure requirements which are primarily meant for investors may not be given since such disclosures would not be relevant for non-public interest entities.

- The disclosures requirements may also not exceed those given in IFRS for SMEs.

Preparedness of Proposed Standard:

Revised Accounting Standards are applicable to entities to which Ind ASs are not applicable. Below table summarizes the categories of revised accounting standards as mentioned in the Approach Paper of the ICAI:

|

Categories |

Basis of the Revised ASs |

No of Revised ASs |

Rational |

|

Category 1 |

Ind AS corresponding to which AS need not to be issued (Ind AS 29, Ind AS 104, Ind AS 106, Ind AS 114, Ind AS 27 & Ind AS 112) |

6 |

As relevance of these 6 AS in category 1 might not be there for MSMCs and SMEs. |

|

Category 2 |

Existing AS which can be revised by including certain aspects from the corresponding Ind AS (AS 11, AS 18, AS 16, AS 21, AS 20, AS 108, AS 24, AS 33, AS 12, AS 34, AS 103, AS 110, AS 28, AS 111) |

14 |

Existing AS to be revised by including certain aspects from the corresponding Ind AS: the corresponding international standards on which existing AS were based have been revised since the formulation of ASs in the past and, accordingly, certain existing ASs need revision taking into consideration certain aspects from corresponding Ind AS. |

|

Category 3 |

Ind AS which can be used as basis for revision of the corresponding existing Accounting Standards with changes (AS 1, AS 2, AS 7, AS 8, AS 10, AS 17, AS 19, AS 23, AS 36, AS 37, AS 38, AS 40, AS 41, AS 105, AS 113, AS 102) |

16 |

To use the Ind ASs as base for formulating Revised ASs is twofold as follows:

|

|

Category 4 |

Standard for which hybrid approach to be followed (AS 109) |

1 |

As IFRS for SME’s to be considered for formulation of upgraded AS 109, Financial Instruments. Also, it covers 3 sections of which 2 sections are using basis of Ind As while section on liability is based on AS 37. |

|

First time adoption |

Ind AS 101 equivalents to be considered |

1 |

A separate standard like Ind AS 101 may be adopted for transition purpose. |

|

Total Number of Revised ASs |

38 |

||

|

Three Ind AS merged into one standard (Ind AS 32, Ind AS 107, Ind AS 109 merged into AS 109) |

2 |

||

|

Ind AS divided into two standards (Ind AS 115 splits into AS 11 and AS 18) |

(1) |

||

|

Total Number of Ind ASs |

39 |

|

Are we ready?

There is an urgent need to revised the existing accounting standards. Some of the concepts and approaches mentioned in the existing accounting standards are outdated and do not provide guidance regarding many of the transactions relevant in the current economic conditions. Also, updating the recognition and measurement principles in line with the Ind ASs would make financial reporting more logical for all stakeholders including the students of financial reporting. However, are we ready?

The Financial Reporting Review Board (FRRB) of the ICAI publishes a publication titled ‘Study on Compliance of financial reporting requirements’ containing instances of non-compliances with the reporting requirements that have been noticed by the Board during the course of review of the general purpose financial statements of enterprises. The Board also publishes a similar publication on Ind AS. One can clearly observe significant proportion of non-compliances from those publications.

There is a need for upskilling the reporting team of enterprises and also the team of auditing professionals. Until these teams are provided proper training and guidance on the revised Standards, instances of non-compliances would only shoot up.

Evolution of Accounting & Auditing Standards and its Future!

When we look at the evolution of standards, broadly, there are three types of standards which the accounting profession should talk about - accounting standards, auditing standards, and naturally the quality control standards, which are considered as a part of auditing standards. If you look at the past, there used to be national standards, international accounting standards, and US-GAAP. Over a period of time, it was found that the international standards and US-GAAP were going in different directions. So, it was felt appropriate to start with IFRS (International Financial Reporting Standards). Every country in the world which has got its own regulatory body would normally evolve its own standards, like we have done in India. These were accounting standards, and the auditing standards.

In India, it is the Institute of Chartered Accountants of India (ICAI) which is standard setting body and the Companies Act has adopted those standards, initially through NACAS (National Advisory Committee on Accounting Standards) and now NFRA (National Financial Reporting Authority). They have the authority to formulate the standards, but the basic standards come from the ICAI. ICAI is a member of the international bodies, and therefore, by and large, we adopt the international standards. As a country, long time back, we decided to adopt IFRS, but with suitable modifications. So, most of the IFRS have been adopted, converged into India, which are now called IND-AS, making them suitable to the local needs of the legal requirements.

The Accounting Standards have become a part of the Companies Act; even the auditing standards have become a part of the Companies Act. While the standards are set, the drafts are issued, various components of the society give their response, those responses are considered, and then it becomes a standard, which is final. It is sent to the specific bodies, like NACAS earlier, now NFRA, and they will issue the standards. When we say evolution of standard, that is how they have evolved.

Ethics and Accounting Standards

By and large, all CA professionals carry a paper for their examination called ethics & value system. It is very nice to have such a paper, but one must consider it appropriate to have the ethics & value system in accounting itself. When we look at the accounting standard, there are two ways in which people analyze the standard.

People find out what is allowed by the accounting standard, and people also find out what is strictly prohibited by the accounting standards. So something which is allowed and something which is prohibited is very clearly known. But there are a few other people who try and find out what is not specifically prohibited by the accounting standard, and that is what gives birth to what is known as “creative accounting”. I think it is the creative accounting which is the first cause of trouble for the accountancy profession in the world at large. Because the more and more creative accounting comes in, that gives rise to problems in the future. This is one area which entire accounting profession will have to be very careful about.

Off Balance Sheet items

The next item will be the off balance sheet items. When we look at the balance sheets, today there are various items which are on the balance sheet, but items like derivatives, embedded derivatives, commitments, right to agree to sell, right not to agree to sell, right to dispose of and many other kinds of rights and obligations which do not necessarily get converted into financial terms, would be the issues that one needs to look at.

Ownership of Standards

The sense of ownership about the standard is a major issue. Today, it appears that the Auditors are owning the standards. I think it is the Industry which has to own the standards, otherwise, it becomes the job of the audit profession across the world to ensure that the standards are complied with. The accounting profession has to ensure that the standards are actually implemented while preparing financial statements and the auditing profession has to see that they are actually implemented by doing the audit. So, the sense of ownership of the standard in India and across the world is very important, and we will have to make efforts to ensure that the industry bodies start owning those standards. Unless this happens, there are going to be troubles in the future.

Constant Changes in Standards

Especially after IFRS has come in, we find that naturally across the world there are issues which are pointed out. Those issues get looked at the highest level; appropriate changes are made, those changes come into IFRS and consequently into Ind-AS. One should welcome such improvements which take place in accounting standards. But, constant changes in accounting standards practically every year, makes some people to believe as if we are changing the goal post.

Accounting standard is something which takes time for the accountants, auditors to understand, implement and practice. For the society to understand the importance it takes a longer time. So there is a need for the accounting profession to keep in mind that we may have to keep the standards constant for a period of two or three years and then make changes at the appropriate time. If something was not right yesterday, just by making it right tomorrow, things are not going to change substantially. That will increase the belief in accounting standards in a much better way.

Accounting & Business Objectives – The Interplay

I think the purposes are different, the business objectives are different. Accounting measures the results of the business operations as they are communicated to the shareholders. And therefore, whenever people try and connect the business objectives with the accounting standards, there are bound to be different perceptions. It has to be clearly understood that accounting is only a unit of measurement to understand, evaluate, record and disclose the results of the businesses as carried out by the business people.

Auditing Standards

When we look at the auditing standards things are slightly different. The measurement of implementation of auditing standard is quite difficult. In accounting, at least one can look at the disclosure results and find out that what is done is right or not. But in auditing, the ultimate result is an audit report, which normally is a standard report. So, by itself, whether standards have been implemented in reality or not is a question mark and that really is the challenge before the audit profession. This is where the documentation becomes important.

Documentation

The performance evaluation of auditors is certainly a question mark and everybody likes to comment on that. The most important thing is the service quality in the audit standards and its implementation and that would depend upon competence coupled with character. Competence alone is not sufficient unless the character is evident to support the competence. In this respect, documentation becomes very important.

Dealing with failures

Generally, as an accounting profession, whenever there are major failures world over or in our country, there is a big noise about standards not being sufficient. What we need to learn is how to deal with failures. Whenever there is a commercial failure, one must find out whether it was a failure of an accounting or auditing standard or was it a failure of an individual person, individual firm or a group of firms?

If we notice that the standards were appropriate, but it was a failure of the individual or firm, one need not talk about changes in accounting standards or the legal requirements but somehow over a period of time, all of us have been used to changes in laws the moment there is a major failure. This is a knee-jerk reaction because if the standards were not up to the mark, by now, the standards would have been substantially changed. Whereas you will find that, actually the standards more or less have remained same for a long period.

As an audit profession the world over, we should be able to distinguish between failure of a standard and failure of the actual implementer of the standard.

Expectations Gap:

There are 2 types of expectation gaps. One is what the society expects and what we promise, there is a gap & the next would be, what we promise and what we perform. I think the second expectation gap is dangerous because what we promise is given by the standards and that when compared to actual performance, if there is a gap, all of us need to improve upon that. But what the society expects and what we promise, if there are gaps in these two items, all over the world various accounting bodies must come forward to meet that gap effectively. We must start educating the society & the most common example is the fraud detection.

Whether detection of fraud is the job of an auditor and can he do it in the course of audit that is done on a quarterly basis, annual basis, etc. is an area on which research would be more useful, especially to see if this was the objective of the auditing standards. Therefore, what effective steps will have to be taken by the auditors in changing the standards? How much time it will take for auditors to detect the fraud every time? And can they really do that? This is a serious problem area for the profession at large in future.

Society Expectations

Automatically, the utility and visibility of the audit profession will depend upon the neatness, compactness and conciseness of the accounting and auditing standards as visualized by the society. Ultimately, this is a service profession. As long as we are good for the society at large, our retention in the society will be permanent. But if we are not found to be good for the society at large, things will be difficult for the audit profession and therefore all over the world we will have to ensure that audit as done today and as we expect to do tomorrow, should be useful to the society.

Where the society expects a change, how do we look at the change to happen? Are we equipped to do the change? And if not, what is it that we can do to make the change?

Standards for Small Audits

One needs to look at whether there is a need for having separate standards for small audits.If there is a need for a separate standard, then one will really have to come out with specific details on that.

Quality Control Standards:

The present quality control standard is so nicely drafted that sometimes one wonders that if everybody was doing that, where was the question of any problems in auditing. Which means that, such a nicely drafted standard will need some implementation guide for all people to follow, so that people exactly know what is to be done out of such standards and implementation will become a reality of life. I hope that is where we will lead by implementing the standards through the quality control standards.

Let us expect the World Congress of Accountants to deliberate on these important issues and come out with proper directions for the future.

Impact of Global Minimum Tax Regime

In October 2021, 137 countries out of 141 Organization of Economic Co-operation and Development (OECD) / G20 member countries agreed to implement a minimum 15% corporate tax rate for multinational entities (global turnover over Euro 750 million) as a part of two pillar approach of OECD’s ground-breaking taxing the digital economy framework. A global deal has been announced between 137 countries, including India, to ensure large MNEs pay a Global Minimum Tax (GMT) rate of 15% by the OECD. Since 2017, the G20 / OECD inclusive framework on Base Erosion and Profit Shifting (‘BEPS’) has been jointly developing a Two-Pillar Solution to address the tax challenges associated with digitalization. At present, the consenting governments are discussing implementation plans.

Why should there be a Global Minimum Tax?

- Digitalization

International tax rules must keep up with the times of the digital age. A number of new issues have arisen as a result of the digital revolution: scale without mass (firms growing without a physical presence), reliance on intangible assets, and the centralization of information. The use of both previously available and new technologies has enabled tax avoidance by shifting profits to low-tax jurisdictions. In order to attract foreign investment, countries are competing with each other on their tax rates. In countries with higher taxes, this results in loss of tax revenue and threatens government functions.

- Tax haven diversion

Drug patents, software, and intellectual property royalties have increasingly been migrating to tax havens to avoid paying higher taxes in their home countries. The GMT aims to stop this outflow of tax revenue in lower tax jurisdictions and aims to eliminate tax heavens. However, a carve-out allows countries to continue to offer Tax incentives to promote business activity with real substance (i.e., tangible assets and personnel).

- Resource mobilization

Global tax revenues will increase by $150 billion a year as a result of the minimum tax, according to the OECD.

- Global tax reforms

It is another positive step towards global taxation reform following the implementation of the BEPS. The term BEPS refers to tax avoidance strategies aimed at shifting profits to low or no tax jurisdictions through mismatches in tax rules.

- Common approach

The Pillar Two rules will have the status of a common approach: countries will not be required to adopt them, but if they choose to, implementation must be in a manner that is consistent with the model rules and IF guidance.

- Tax competition

On account of low or no tax jurisdictions, countries are facing harmful tax competition. Addressing such competition, coherence of international tax rules and ensure transparent tax environment is essential.

What is the proposed tax structure?

It is based on a two-pillar system that should improve current corporate taxation rules.

Reallocation of a residual profit to market jurisdictions (Pillar One)

The first pillar pertains to the implementation of new profit allocation rules applicable to the largest and most profitable MNEs (Multinational Enterprises) with worldwide revenues greater than Euro 20 billion and profitability greater than 10%. If implementation succeeds, this amount could also be reduced to Euro 10 billion in 7 years. The objective of this pillar is to redistribute excess profits of MNEs to jurisdictions where consumers or users reside, regardless of whether firms are physically present there. The redistribution amount is calculated by dividing residual profits by 25%. The result should be a more equitable distribution of profits and taxing rights among countries.

Global minimum tax (Pillar Two)

The Pillar Two proposes a global minimum tax to eliminate incentives for companies to shift profits based solely on tax outcomes. Competing countries may offer tax incentives or lower tax regimes to attract inward investment. Furthermore, multinationals who derive significant value and profit from intangibles may be able to move income and profit to these low-tax jurisdictions due to differences between domestic tax rules.

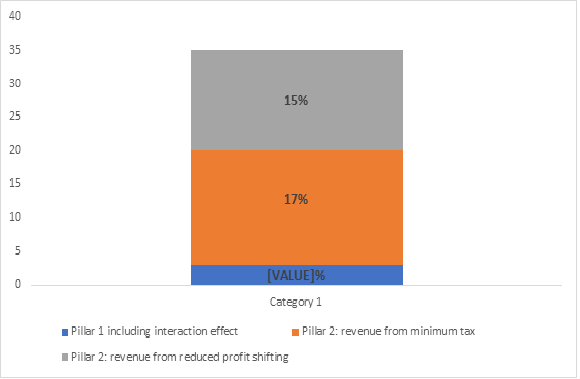

Illustration 1- Chart- Pillar 2- Estimated impact on corporate tax revenues

Gains in global tax revenues (% of CIT revenues)

Note: This estimate for Pillar One (amount A only) is based on an example in which residual profit is defined as profits above 10% of profit before tax to turnover, assuming a 25% reallocation of residual profile to market jurisdictions, excluding commodities and financial sectors. As an illustration, the Pillar Two estimates are based on a jurisdiction that blends a minimum tax rate of 15%.

*source-OECD

Tax policy implications of a global minimum tax

First, a global minimum tax will neutralize the low tax incentive, and second, it may effectively lead to tax revenues being exported to other countries.

A global minimum tax will inevitably increase pressure on countries with headline rates below the global minimum to increase their domestic rates, especially if not doing so will effectively export tax revenue. Assuming a global minimum tax rate of 15%, or slightly higher, some tax-based incentives and substance-based incentives will likely survive. It is possible, though, that non-tax platforms and taxes based on non-profits could shift competition over time.

There will, however, be inevitable changes in the methodology for taxing any global minimum tax rate. These changes will redefine what constitutes a legitimate tax base, a legitimate tax, and a legitimate tax rate.

Decoding Recent Developments in Sustainability Reporting in India

(with contributions from Mr. Nishit Jain)

2021: SEBI announced Business Responsibility & Sustainability Reporting (BRSR) requirements to the top 1,000 listed companies by market capitalisation. Voluntary for FY 21-22 and mandatory for FY 2022-2023.

80% of the top 100 companies for sustainability and CSR in 2021 incorporate Sustainable Development Goals (SDGs) in their responsible business actions. The list of top 100 companies for Sustainability and CSR in 2021, prepared by Futurescape, reveals that the top 25 companies also map their business goals with respect to SDGs.

There is an increasing acceptance of non-financial reporting in India considering the regulatory push on listed entities to report on BRSR and also the push from the investor community to mandate private companies (investees) to have sustainable business models, which in turn results in investees reporting on their compliance with this requirement.

The recent amendment inserts a Chapter X-A of SEBI (Issue of Capital and Disclosure Requirements) Regulations 2018 dealing with the Social Stock Exchange (SSE)

2022: SEBI introduced Chapter X-A provisions of SEBI (Issue of Capital and Disclosure Requirements) Regulations 2018 which governs Not-for-Profit-Organisations that are seeking registration and raising funds through an SSE.

An SSE shall be accessible only to institutional investors and non-institutional investors. However, SEBI may permit other class(es) of investors, as it deems fit, for the purpose of accessing the SSE.

Every SSE shall constitute a Social Stock Exchange Governing Council to have oversight on its functioning. The composition and terms of reference for such Governing Councils shall be specified by the Board from time to time.

Recently introduced Chapter IX-A of SEBI (Issue of Capital and Disclosure Requirements) Regulations 2018 on obligation of Social Enterprises.

A Profit Social Enterprise whose designated securities are listed on the Stock Exchange(s) shall comply with the disclosure requirements contained in these regulations with respect to issuers whose specified securities are listed on the main board or the SME exchange or the innovators growth platform, as the case may be.

Disclosures by a Not-for-Profit Organisation.

A Not-for-Profit Organisation registered on the SSE(s), including a Not-for-Profit Organisation whose designated securities are listed on the SSE(s), shall be required to make annual disclosures to the SSE(s) on matters specified by the Board, within 60 days from the end of the financial year or within such period as may be specified by the Board.

In addition to the disclosures referred to above, the SSE(s) may specify matters that shall be disclosed by the Not-for-Profit Organisation on an annual basis.

Intimations and disclosures by Social Enterprise of events or information to SSE(s) or Stock Exchange(s)

- A Social Enterprise whose designated securities are listed on the SSE(s) or the Stock Exchange(s), as the case may be, shall frame a policy for determination of materiality, duly approved by its board or management, as the case may be, which shall be disclosed on the SSE(s) or the Stock Exchange(s).

- The board and management of the Social Enterprise shall authorise one or more of its key managerial personnel to determine the materiality of an event or information and to make disclosures to the SSE(s) or the Stock Exchange(s), as the case may be, under this regulation and the contact details of such personnel shall also be disclosed to the SSE(s) or the Stock Exchange(s).

- A Social Enterprise whose designated securities are listed on the SSE(s) or the Stock Exchange(s), as the case may be, shall disclose to the SSE(s) or the Stock Exchange(s) where it is registered or has listed its specified securities, as the case may be, any event that may have a material impact on the planned achievement of outputs or outcomes.

- The disclosure shall be made as soon as reasonably possible but not later than seven days or within such period as may be specified by the Board, from the occurrence of the event and shall comprise details of the event including the potential impact of the event and the steps being taken by the Social Enterprise to address the same.

- The Social Enterprise shall provide updates on a regular basis along with relevant explanations in respect of the disclosures required till the time the concerned event remains material.

- The Social Enterprise shall provide a specific and adequate reply to all queries raised by the SSE(s) or the Stock Exchange(s), as the case may be, with respect to any events or information.

- The Social Enterprise may suo moto confirm or deny any reported event or information to SSE(s) or the Stock Exchange(s), as the case may be.

- The Social Enterprise shall disclose on its website all such events or information which have been disclosed to the SSE(s) or the Stock Exchange(s), as the case may be, under this regulation.

Scorecard of Recent SEBI Amendments For Bettering Governance & Compliance

(with contributions from Mr. Aleem Lilani and Mr. Mayank Parekh)

India has evidenced amendments in various regulations recently to increase the transparency in functioning and enhance the quality of Financial Reporting.

Highlighted below are few of the recent regulatory changes from SEBI and their effects on the listed entities they regulate, in a step toward better governance and compliance.

- SEBI (Listing Obligations and Disclosure Requirements) Amendment, 2022, provides the requirement of at least one-third of the Board of Directors to comprise of independent directors with the chairperson being a non-executive director and at least half of the Board of Directors to comprise of independent directors where the listed entity does not have a regular non-executive chairperson. The definition of Related Party has undergone a change with effect from 01 April 2023, wherein any person or entity forming a part of the promoter or promoter group of the listed entity holding 10% or more in the listed entity either directly or on a beneficial interest basis shall become a related party. Earlier, the specified percentage prescribed was 20%.

- The materiality of Related Party Transaction (RPT): Previously, a transaction was considered material during a financial year if it exceeded 10% of the annual consolidated turnover of the listed entity as per the last audited financial statement of the listed entity, but with effect from 01 April 2023, an RPT would be considered as material if the transaction entered into individually or taken together with previous transactions during a financial year exceeds INR 10bn or 10% of the annual consolidated turnover of the listed entity as per the last audited financial statement of the listed entity, whichever is lower. Prior approval of the shareholder of a listed entity is needed for all material RPTs and subsequent material modifications of such transactions.

- Related Party Transactions: The amended definition of ‘Related Party’ would now include not only the transaction of a listed entity but also transactions of the subsidiary with the related party of a subsidiary company. This implies that the listed entity would have to meet the approval and disclosure requirements even with respect to RPTs of a subsidiary company, where the listed entity is not a party. Additionally, with effect from 01 April 2023, the definition deems certain categories of unrelated transactions also as RPT, i.e. the purpose and effect of such transactions is to benefit a related party of the listed entity or any of its subsidiaries.

- Amendments to SEBI (Alternative Investment Funds) Regulations 2022 (AIFs):

- Category AIFs shall invest a maximum of up to 10% of the investable funds in an Investee Company directly or through investment in the units of other AIFs except for large value funds for accredited investors of Category III AIFs which may invest up to 20%.

- However, for investment in listed equity of an Investee Company, Category III AIFs and large value funds for accredited investors, may calculate the investment limit of 10% and 20% respectively of either the investable funds or the net asset value of the scheme.

- Change in control of Sponsor and/or Manager of AIF involving Scheme of Arrangement under Companies Act, 2013:

As per SEBI, the following shall be applicable to all the Schemes which are filed with The National Company Law Tribunal (NCLT) on or after 01 April 2022:

- The application seeking approval for the change in control of the Sponsor and/or Manager of the AIF (under the applicable AIF Regulations) shall be filed with SEBI prior to filing the same with the NCLT.

- SEBI shall grant an in-principal approval upon being satisfied with the compliance of applicable regulatory requirements, the validity of which shall be 3 months from the date of issuance within which the relevant application shall be made to the NCLT.

- Within 15 days from the date of the order of NCLT, the applicant shall submit the NCLT-approved application and its order along with other specified documents to SEBI for final approval.

- SEBI (Issue and Listing of Non-Convertible Securities) (Amendment) Regulations, 2022 states the conditions for Issuing and Listing of Non-Convertible Securities:

- General Obligations: The issuer has to consider higher security cover as per the terms of the Offer Document/Debenture Trust Deed which should be sufficient to discharge the principal amount and the interest thereon.

- Creation of Charge: The charge created on secured debt securities shall be disclosed in the offer document as well as the Debenture Trust Deed. The condition is applicable in case of public/private issues and listing of debt securities.

- Issue of Due Diligence Certificate: The Debenture Trustee must furnish a separate Due Diligence Certificate for each of the secured and unsecured debt securities, to the board and stock exchange(s), at a prescribed time and format. The condition is applicable in case of Public/Private issue of debt securities and private placement of non-convertible redeemable preference shares.

- Disclosure: An issuer seeking to issue its debt securities is required to include the details of credit rating along with the latest press release (not older than a year) of the credit rating agency validating the rating as on the issue and listing date.

Audits and Auditors in the USA - From the Eyes of Indian Companies

Requirement for audited financial statements in the USA

The simple purpose of a financial statement audit anywhere in the world is to add credibility to the reported financial position and performance of a business. In India, all private companies and public companies (Companies listed in stock exchanges) are mandatorily audited by a Chartered Accountant or firm of Chartered Accountants with Certificate of Practice (COP) from Institute of Chartered Accountants of India. In the USA, the Securities and Exchange Commission (SEC) requires that all entities that are publicly held must file annual reports with it that are audited. This also means that the Companies that are not public will not require mandatory audit.

However there are many instances in which audited financial statements are required even for non- public company such as: certain bank financing requirements, vendor, customer requirements, United States Citizenship and Immigration Services (USCIS), Corporate governance requirements or in case of subsidiary of public listed company of India to meet stock exchange requirements , for filing annual performance reports (APR) with Reserve Bank of India or any of regulatory requirements depending on the state business licensing requirements.

Audit services in the USA

In the USA, audit services are provided by Certified Public Accountants (CPAs) or firm of Certified Public Accountants who are licensed by respective state board of accountancy.

Applicable Accounting Standards in the USA

The financial statements are prepared according to the US generally accepted accounting principles (US GAAP). There are differences in accounting standards in the US as against the accounting standards applicable in India. Therefore, the reported financial results and position of the Company could vary under the US GAAP as against the Indian GAAP. These will need to be analyzed on case-to-case basis.

Alternatives other than audits

CPAs can provide review and compilation services, which may be suitable to some financial statement users as an alternative to audited financial statements. A review provides limited assurance, based mainly on analytical procedures and inquiries, that the CPA is not aware of any material modifications necessary for the financial statements to conform to US GAAP. It does not involve obtaining an understanding of the company’s internal controls or any testing of the underlying information. Reviewed financial statements include the identical disclosures as audited financial statements. In a compilation, the CPA assists management only in presenting financial information in financial statement format, without any assurance as to its reliability.

Selection of CPA firm

CPA firm selection for audit should be based on the reputation in the financial society, qualification, staffing and the industry experience. Further matters of consideration could be knowledge of US GAAP and Indian GAAP considering that at your corporate level you need to consolidate the financial statements of your US business. Another matter that may be important is that your records are maintained at your back office in India, in these cases a firm with presence in US and in India could be required.

ICAI – A Knowledge Based National Standard Setter

(with contributions from Mayank Jain and Vikram Rawat)