Budget 2021 : Fine Print Decoded

Budget 2021 – Impact Analysis from M&A Perspective

This article has been co-authored by Saurabh Mehta (Director), Deals Tax, PwC India.

Despite the Central Government’s proactive measures during the past year, the Union Budget 2021 was still expected to deliver on global sentiments in India’s run towards economic recovery from the COVID-19 pandemic. The Budget expectations show continued growth momentum. Although the Central Government has maintained status quo on the direct tax front, a few noteworthy changes have been introduced by the Finance Bill, 2021. Most of these proposed changes affect the corporate restructuring and acquisitions and are outlined below.

- REITs / InvITs

Finance Act, 2020 abolished the dividend distribution tax payable by companies by moving to the conventional manner of levying tax in the hands of shareholders. Owing to shareholder-level taxation, companies are required to deduct tax at source (TDS) at prescribed rates, while declaring dividends to shareholders.

Despite the tax pass-through status enjoyed by Real Estate Investment Trusts (REITs) and Infrastructure Investment Trusts (InvITs), the Finance Act, 2020 imposed the requirement of deducting tax at source on dividends declared and paid to these trusts. This led to compliance burden and short-term cash flow issues. Finance Bill, 2021 offers respite thereof by eliminating the requirement of TDS on dividends payable to such REITs and InvITs. This move helps in making investments in units of REITs and InvITs more lucrative to investors.

Further, to enable better access of finance to REITs and InvITs, it is also proposed to permit debt financing of REITs and InvITs by Foreign Portfolio Investors, thereby encouraging fund flow in the development of real estate and infrastructure assets.

- Relaxations to real estate sector

The Central Government has incentivized the housing sector by extending the eligibility for availing income-tax holiday on all affordable housing projects approved up to 31 March, 2022, from the current date of 31 March, 2021. It is further proposed to extend tax holiday benefit to notified rental housing projects also.

For transfers of residential properties for a consideration upto ₹ 2 crores, Finance Bill, 2021 proposes to increase safe harbour from the current 10% to 20%, for such transfers made between 12 November 2020 and 30 June 2021, as a first-time allotment.

- Depreciation claim on goodwill:

In a bold move by the Central Government, Finance Bill, 2021 proposes to reverse a landmark Supreme Court ruling, wherein it was held that goodwill of a business is an intangible asset eligible for depreciation.

Prior to this proposed amendment, there was ambiguity on whether goodwill of a business, acquired as a part of business acquisitions or corporate reorganizations is eligible for depreciation. Finance Bill, 2021 settles this controversy by proposing to specifically exclude ‘goodwill of a business or profession’ from being classified as a depreciable asset.

However, this amendment may be a barrier for genuine cases of acquisitions, which inherently factor a price for goodwill. Such genuine transactions will not be eligible for immediate benefit by way of depreciation. Instead, Finance Bill, 2021 allows the price paid towards goodwill as its cost of acquisition if, and when, such goodwill is subsequently transferred.

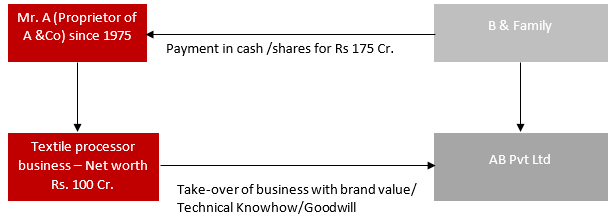

- Taxability of slump exchange

The definition of ‘slump sale’ under Income-tax Act, 1961 (‘Act’) currently only covers transfer made by way of sale. The term ‘sale’ has not been defined in the Act. Hence, there has been ambiguity on whether the transfer of business in exchange of consideration in kind is taxable.

Finance Bill, 2021 now proposes to tighten the definition of slump sale given in section 2(42C) of the Act, so as to cover inter alia transfer by way of exchange or any other means. It is pertinent to note that this amendment is proposed to be effective retrospectively from 1 April, 2020.

- Rationalising distributions made by firm to its partners

The current provisions of the Act provide for taxability of capital gains arising on distribution of capital assets by a firm to its partners in the event of dissolution or otherwise. Despite multiple divergent pronouncements, the uncertainty still looms on: (i) taxability on distribution of cash and; (ii) taxability in cases of admission and retirement of partners wherein the partners’ capital was increased by revaluing assets of the firm.

Finance Bill, 2021 proposes to levy tax on capital gains in the hands of firm on any distributions made to its partners on dissolution or reconstitution, whether in the form of capital assets or other assets or cash. Goodwill or any other form of upward revaluation to partners’ account, has to be ignored while computing the capital account balance of the partners.

However, Finance Bill, 2021 does not prescribe a manner to determine the nature of capital gains (long-term/ short-term) in the hands of firm/ partners. Clarifications from the Central Government will be welcome in this regard.

- TDS on goods:

Finance Act, 2020 introduced an obligation on specified persons to collect tax at source from buyers, at the time of sale of goods. The term ‘goods’ has not been defined in the Act; and hence, this led to interpretational issues on the applicability of tax collected at source (TCS) on sale of shares and businesses. Moreover, the requirement to collect tax at 0.1% increased the transaction size / ticket size for buyers, resulting in short-term marginal cash flow problems.

In this context, Finance Bill, 2021 addresses the problem by introducing a TDS obligation on prescribed buyers, who are now required to deduct tax at source while purchasing goods from resident sellers. The same can be claimed as tax credit by such sellers. Consequently, the TCS requirement seem to be discarded, for transactions on which TDS is made applicable.

Considering the above changes, the Central Government has indeed announced a Budget with some focus on the M&A ecosystem. This paves the way for a resilient and transparent tax framework. Although some announcements are welcome, certain other proposals, such as eliminating depreciation on goodwill, will be met with skepticism in the corporate marketplace.

Depreciation on Goodwill: A Hard Pill to Swallow for Corporates

This article has been co-authored by Jatan Shah (Senior Manager) and Aashni Shah (Assistant Manager), Deloitte Haskins & Sells.

The Finance Minister had promised to reset the economy and deliver a Budget that would ease the economic tension prevailing in the country. While a handful of amendments have been proposed to revive the economy and boost the “Aatmanirbhar” initiative, a peculiar amendment towards goodwill on business and profession has certainly rocked the boat for many corporates.

The long-drawn dispute of whether depreciation can be claimed on goodwill for the purpose of business and profession has been put to rest by the amendments proposed in the Budget, by specifically carving out goodwill on business and profession as a depreciable asset for income tax purposes.

Generation of goodwill:

In case of business acquisitions, goodwill arises when the purchaser pays a consideration which is higher than the valuation of the business. As per the accounting standards, both IGAAP and Ind-AS, such excess consideration is to be recorded as goodwill in the books of accounts of the acquirer.

Accordingly, for tax purpose, such goodwill, being in the nature of a business or a commercial right, was recognised as an intangible asset and since there was no specific exclusion of goodwill as a depreciable asset, depreciation @25% on such goodwill was generally claimed by many corporates.

Current scenario:

Currently the courts across India have expressed divergent views on this subject matter which has created an air of confusion amongst the corporates. Relying on the favorable Supreme Court decision in the case of Smifs Securities, many corporates have taken a view that depreciation should be available on goodwill and have accordingly concluded their transactions.

In the past, where the consideration paid on acquisition of business was much higher than the actual value of business, the tax authorities had claimed that the restructuring transactions were orchestrated only to claim depreciation on goodwill and thereby reduce its tax outflow.

It was imperative to put an end to this prolonged issue which had created a lot of ambiguity leading to excessive litigation costs and undue hardships on the corporates.

Amendments proposed:

The amendments proposed by the Budget has excluded goodwill from the definition of ‘block of assets’ and the list of assets which are eligible for claiming depreciation under the Income Tax Act, 1961 (‘the Act’). Thus, the benefit which was available to the corporates in the form of depreciation on goodwill recorded in the books of accounts will now no longer be available, thereby creating a higher tax outgo in the hands of the acquirer entity.

The amendment further proposes to prescribe a specific computation mechanism to determine the written down value and short term capital gains in case where depreciation on goodwill has already been claimed by the assessee.

Further, the proposed amendments also provides that the cost of acquisition of such goodwill, will be reduced by the depreciation already claimed thereon.

Subsequent amendments are also proposed to deal with the cost of acquisition and computation of capital gains on account of goodwill, on which depreciation has already been claimed.

Impact on on-going litigations:

While the amendment has put a rest on the disputes for all future restructuring transactions, the fate of ongoing assessments and litigation still remains uncertain. The issue which needs to be pondered upon is, what will be the course of action that will be adopted by the tax authorities.

The proposed amendments are applicable from financial year (FY) starting 1 April 2020 and may not impact any transactions which are undertaken prior to this date. However, there could be a challenge for companies who have already claimed depreciation on goodwill in the current FY and have paid advance taxes taking into consideration such depreciation claim . Such companies might be subjected to interest liablity on such default in payment of advance taxes and they may have to shell out further cash.

Other practical difficulties:

While the aforesaid amendments is a welcome move to curb the transactions which were undertaken only for the purpose of evading taxes, it will cause onerous burden on the acquirers in case of genuine transactions. Depreciation will also not be allowed in case where excess amount is paid towards genuine goodwill of the business. This will lead to a cash outflow towards acquisition of asset without any corresponding tax benefit.

No clarity has also been provided in case of depreciation on other acquired intangible assets such as customer contracts, customer list and workforce, which can still be subject to ambiguity.

While the long awaited ask for clarity on depreciation on goodwill has been finally addressed by the Budget and it may also reduce litigation going forward, there are certain taxpayers who are left in a soup due to this amendment. Clear internal directives will be required to be issued by the CBDT to control tax authorities from taking adverse actions against taxpayers, where transactions are already concluded.

Information for the editor for reference purposes only

Equalisation Levy – Budget 2021 Impact!

Equalisation Levy (‘EL’) – Recap

EL was introduced by India in 2016, on the lines of the recommendations of the OECD BEPS Action Plan 1 aiming to tax revenues generated by online businesses who would not fall under the tax net applying the conventional tax norms. Scope of the levy was expanded by the Finance Act, 2020 to cover specified e-commerce business thereby subjecting revenues from e-commerce supply or services (‘ESS’) provided or facilitated by an e-commerce operator (‘ECO’) to a EL of 2%. Exceptions were carved out for smaller players or those having permanent establishment in India. Parallelly, income tax exemption for such income was introduced, although some changes were rqeuired on this front.

As one would recollect, the EL regime does not form part of the income tax framework but is housed under a separate code thereby leaving room for double taxation, which has caused considerable angst amongst the ECOs. There was some ambiguity pertaining to overlap between the EL provisions and the other income tax provisions for taxing income earned by such entities.

Amendments proposed by Finance Bill, 2021 (‘FB 2021’)

Syncing dates of EL and corresponding exemption from Income Tax:

While the expanded EL provisions were made applicable from 1 April 2020, the consequential amendment to Section 10(50) of Income Tax Act, 1961 (‘Act’) provided income tax exemption such income (i.e. subject to EL) only from 1 April 2021 which could have resulted in double taxation of said income arising in the period 1 April 2020 to 31 March 2021. This date mismatch is being plugged by the proposed amendment to Section 10(50) making the exemption effective from 1 April 2020 i.e. FY 2020-21 addressing a much required ask of the industry.

Clarification to avoid double taxation of Royalty / Fees for Technical Services

Proposed Explanation 1 to Section 10(50), the FB 2021 provides that effective 1 April 2020, income referred to in Clause 10(50) shall not include any income which is chargeable to tax in India in accordance with the provisions of the Act, read with the relevant Double Tax Avoidence Agreement, as Royalty or Fees for Technical Services. Similar changes have also been made to Section 163 of the Finance Act, 2016 (‘FA 2016), which is the EL charging provision. In addition to being taxed in case it has a permanent establishment in India, ‘Royalty’ and ‘Fees for Technical Services’ are the typical heads under which the non-resident ECOs see their income being taxed and thus, this clarification will go a long way in avoiding unwarranted litigation.

Retrospective clarification to clarify position on offline/ physical supply of goods and services

For the purposes of charging EL, ESS includes online sale of goods owned/ online provision of services provided/ facilitated by the ECO or a combination of these activities. To reduce ambiguity regarding coverage of any offline/ physical supply of goods and services, FB 2021 proposes to introduce an Explanation to Section 164(cb) of the FA 2016 clarifying that “online sale of goods” and “online provision of services" shall include one or more of the following activities taking place online: acceptance of offer for sale; placing or acceptance of the purchase order; payment of consideration; or supply of goods or provision of services, partly or wholly. While the intent of the provision is to bring clarity, the impact will need to be assessed depending on individual circumstances as the provision still appears to be wide enough to bring the ECO under the EL regime if even one of the parts of the supply/ sevice value chain is via digital means.

Matching coverage of EL and definition of consideration for an ECO

To remove any ambiguity around provisions pertaining to consideration on which EL is applicable, Section 165A of FA 2016 is proposed to be modified to provide that consideration from ESS includes consideration for sale of goods irrespective of whether the operator owns the goods; and that for provision of services irrespective of whether service is provided or facilitated by the ECO.

The above changes are indeed welcome and proof that the Indian Tax Authorities is cognizant of the difficulties being faced by the industry. It is also proof of the Government’s firm resolve to proceed with the levy inspite of the backlash it is facing from the US side which is accusing the Indian Tax regime of levying a unilateral tax on its digital companies!

Finance Bill’2021- Paradigm shift in the provisions relating to Income Tax Search and Seizure Assessments and Income Tax Settlement Commission

Introduction:-

The Hon’ble Union Finance Minister Nirmala Sitharaman has presented the Union Budget 2021 of India on the 1st of February, 2021. Budget 2021 is aimed at reviving an economy that plunged into deepest recorded slump amid the COVID-19 pandemic. In her speech, Hon’ble Madam Sitharaman announced that India’s fiscal deficit is set to jump to 9.5 per cent of Gross Domestic Product in 2020-21 as per Revised Estimates. This is sharply higher than 3.5 per cent of GDP that was projected in the Budget Estimates. A slump in government revenues amid the Covid-19 pandemic has led to a sharp rise in deficit and market borrowing. This was Sitharaman’s third budget under the National Democratic Alliance (NDA) government led by Prime Minister Narendra Modi. In a significant departure from the tradition, this year’s Budget was not printed and was only made available in a digital format.

In significant changes to the taxation process, among other tax measures, the Hon’ble Finance Minister recommend paradigm change to the provisions relating to “Assessment in case of Search or requisition viz. Section 153A to 153D” and Income Tax Settlement Commission.

Proposed Changes relating to Income Tax Search and Seizure and Income Tax Settlement Commission :-

- Changes relating to Income Tax Search and Seizure Assessments:-

- Existing Legal Framework before 01-02-2021:-

Section 153A of the Income Tax Act’1961- Assessment in case of search or requisition (forming part of Chapter XIV of the Income Tax Act’1961- Procedure for Assessment) provides for assessment in the case of a person in whose case a search is initiated under section 132 of the Act or documents or assets are requisitioned under section 132A of the Act after May 31st, 2003. In such a case the Assessing Officer was obligated to issue notice u/s 153A in respect of 6 preceding years and relevant assessment year(s), immediately preceding the year in which search has been initiated. Thereafter he has to assess or reassess the total income of these six years. It is obligatory on the part of the Assessing Officer to assess or reassess total income of the six years and relevant assessment year(s) as provided in section 153A(1)(b) and reiterated in the 1st proviso to this section. The second proviso states that the assessment or reassessment pending on the date of initiation of the search or requisition shall abate.

At the outset it will be relevant to mention that under the existing search assessment procedure as contained under sections 153A to 153D concerning the assessment in a case where search under section 132 or requisition under section 132A is initiated were brought on the statute only w.e.f. 1-6-2003. Qua the search assessments earlier applicable procedure was contained in Chapter XIV-B (sections 158B to 158BI) wherein only undisclosed income mentioned in the seized documents, etc., relatable to the block of ten years was liable to be brought to tax and for the regular income Assessing Officer had to frame the normal assessments.

Section 153C of the act contains the procedure for assessment of income of persons other than that of the person searched which are covered u/s 153A of the act. Section 153C is a replacement to erstwhile “Section 153BD: Undisclosed income of any other person” contained in Chapter XIV-B which was made inoperative for searches initiated u/s 132 of the act after the 31st day of May’2003. Section 153C of the act comes into play when the books of accounts, documents , assets seized in a search action from one person actually belongs to/pertains to/relates to some other person who has not been subjected to such a search action.

- Proposed changes recommended in Finance Bill 2021:-

The Finance Bill 2021 proposes a completely new procedure of assessment in cases of initiation of search on or after 1st April’2021.

The salient features of new procedure are as under:-

- The provisions of section 153A and section 153C, of the Act are proposed to be made applicable to only search initiated under section 132 of the Act or books of accounts, other documents or any assets requisitioned under section 132A of the Act, on or before 31st March 2021.

- Assessments or reassessments or in re-computation in cases where search is initiated under section 132 or requisition is made under 132A, after 31st March 2021, shall be under the new procedure.

- Section 147 proposes to allow the Assessing Officer to assess or reassess or re-compute any income escaping assessment for any assessment year (called relevant assessment year).

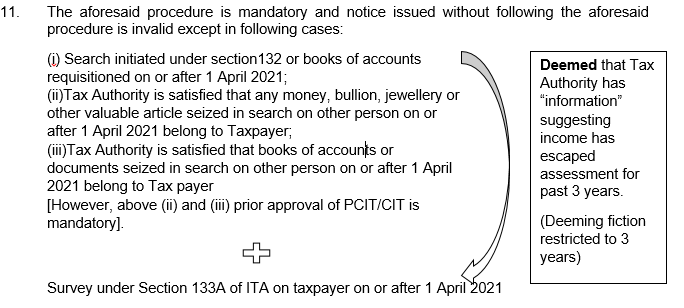

- Further, in search, survey or requisition cases initiated or made or conducted, on or after 1st April, 2021, it shall be deemed that the Assessing officer has information which suggests that the income chargeable to tax has escaped assessment in the case of the assessee for the three assessment years immediately preceding the assessment year relevant to the previous year in which the search is initiated or requisition is made or any material is seized or requisitioned or survey is conducted.

- New Section 148A of the Act proposes that before issuance of notice the Assessing Officer shall conduct enquiries, if required, and provide an opportunity of being heard to the assessee. After considering his reply, the Assessing Office shall decide, by passing an order, whether it is a fit case for issue of notice under section 148 and serve a copy of such order along with such notice on the assessee. The Assessing Officer shall before conducting any such enquiries or providing opportunity to the assessee or passing such order obtain the approval of specified authority. However, this procedure of enquiry, providing opportunity and passing order, before issuing notice under section 148 of the Act, shall not be applicable in search or requisition cases.

- Years covered under Assessment : In normal cases, no notice shall be issued if three years have elapsed from the end of the relevant assessment year. Notice beyond the period of three years from the end of the relevant assessment year can be taken only in a few specific cases where the Assessing Officer has in his possession evidence which reveal that the income escaping assessment, represented in the form of asset, amounts to or is likely to amount to fifty lakh rupees or more, notice can be issued beyond the period of three year but not beyond the period of ten years from the end of the relevant assessment year.

These amendments will take effect from 1st April, 2021.

[Refer Clauses 35 to 40 and 42 to 43 of the Finance Bill’2021]

Analysis:-

The Hon’ble Finance Minister made a significant change to the well existing scheme of the Income Tax Assessments pursuant to a search and seizure action. In nutshell, the provisions of Section 153A and 153C shall not apply to search or requisition cases initiated or made or conducted, on or after 1st April, 2021.

While doing so, the reasons advanced in the memorandum explaining the provisions of Finance Bill’2021 are that the existing search assessment framework ( like the erstwhile block assessment procedure under Chapter XIV-B of the Act) has failed to in its objective of early resolution of search assessments and were proving to be highly litigation-prone. The Bill proposed a completely new procedure of assessment of such cases. It is expected that the new system would result in less litigation and would provide ease of doing business to taxpayers as there is a reduction in time limit by which a notice for assessment or reassessment or re-computation can be issued.

For searches conducted on or after 1st April’2021, then forth, assessments shall be framed under Section 147 read with section 148, 148A, 149,151 of the Income Tax Act’1961.

The mandatory assessment of 6 years immediately preceding the year of search has been done away with and now only past 3 assessment years shall be covered under assessment unless the Assessing Officer has in his possession evidence which reveal that the income escaping assessment, represented in the form of asset, amounts to or is likely to amount to fifty lakh rupees or more, notice can be issued beyond the period of three year but not beyond the period of ten years from the end of the relevant assessment year.

Prima Facie, the cumbersome processes and administrative procedure of recording of satisfaction u/s 153C of the act has not been taken away. W.e.f. 01st April’2021, the satisfaction has to be recorded with the prior approval of Principal Commissioner or Commissioner that any money , bullion, jewellery or other valuable article or things so seized or requisitioned belongs and books of accounts or documents so seized or requisitioned pertain or pertains to any other person other than the person searched.

Interestingly, the concept of dual assessment(s) seems to be revived again as the pending assessments now on the date of search shall not abate. Furthermore, in the erstwhile scheme, by virtue of Section 153B, the assessments were bound to be completed within a period of twelve months from the end of financial year in which the last of the authorization for search under section 132 or for requisition under section 132A was executed. With the introduction of new search assessment procedure by the Finance Bill 2021 pending the passage of the bill and presidential assent, it is apparent that the limitation shall now be governed by Section 153 of the act and shall be dependent on financial year in which the notice u/s 148 was served.

- Changes relating to Income Tax Settlement Commission:-

- Existing Legal Framework before 01-02-2021:-

Chapter XIX - A of Income Tax Act, 1961 provides for settlement of cases. Income Tax Settlement Commission was set up in the year 1976 on the recommendation of Direct Tax Enquiry Committee headed by former Chief Justice of India, Shri K. N. Wanchoo. Chapter XIX – A of Income Tax Act, 1961 comprises of Section 245A to 245M. Section 245C of the Act empowers the assessee to move an application at any stage of a case relating to him and thereby to make a full and true disclosure of income, which has not been disclosed before the Assessing Officer subject to rider contained in section 245C of the Act. The Settlement Commission may allow or reject the application, but in any case in view of provision contained in section 245C of the Act, the application moved under sub-section (1) of the said section, cannot be allowed to be withdrawn by the applicant. The application so moved under section 245C of the Act should be processed by the Settlement Commission in view of procedure prescribed in section 245D of the Act within the specified period provided therein. The provision contained in section 245D provides that the Settlement Commission shall give opportunity to the applicant and to the Settlement Commission, which includes personal hearing or hearing through representative and then pass such order as it thinks fit on the matters covered by the application, which includes any other matter relating to case not covered by the application but referred to in the report of Commissioner, Income-tax.

- Proposed changes recommended in Finance Bill 2021:-

The Finance Bill 2021 proposed the discontinuation of Income Tax Settlement Commission with immediate effect i.e. 1st February’2021. It is proposed to discontinue Income-tax Settlement Commission (ITSC) and to constitute Interim Board of settlement for pending cases.

The various amendments proposed are as under:

- ITSC shall cease to operate on or after 1st February, 2021

- No application under section 245C of the Act for settlement of cases shall be made on or after 1st February, 2021;

- All applications that were filed under section 245C of the Act and not declared invalid under sub-section (2C) of section 245D of the Act and in respect of which no order under section 245D(4) of the Act was issued on or before the 31st January, 2021 shall be treated as pending applications.

- Where in respect of an application, an order, which was required to be passed by the ITSC under section 245(2C) of the Act on or before the 31st day of January, 2021 to declare an application invalid but such order has not been passed on or before 31st January, 2021, such application shall be deemed to be valid and treated as pending application.

- The Central Government shall constitute one or more Interim Board for Settlement (hereinafter referred to as the Interim Board), as may be necessary, for settlement of pending applications. Every Interim Board shall consist of three members, each being an officer of the rank of Chief Commissioner, as may be nominated by the Board. If the Members of the Interim Board differ in opinion on any point, the point shall be decided according to the opinion of majority.

- On and from 1st February, 2021, the provisions related to exercise of powers or performance of functions by the ITSC viz. provisional attachment, exclusive jurisdiction over the case, inspection of reports and power to grant immunity shall apply mutatis mutandi to the Interim Board for the purposes of disposal of pending applications and in respect of functions like rectification of orders for all orders passed under sub-section (4) of section 245D of the Act. However, where the time-limit for amending any order or filing of rectification application under section 245(6B) of the Act expires on or after 1st February, 2021, in computing the period of limitation, the period commencing from 1st February, 2021 and ending on the end of the month in which the Interim Board is constituted shall be excluded and the remaining period shall be extended to sixty days, if less than sixty days.

- With respect to a pending application, the assessee who had filed such application may, at his option, withdraw such application within a period of three months from the date of commencement of the Finance Act, 2021 and intimate the Assessing Officer, in the prescribed manner, about such withdrawal.

- Where the option for withdrawal of application is not exercised by the assessee within the time allowed, the pending application shall be deemed to have been received by the Interim Board on the date on which such application is allotted or transferred to the Interim Board.

- The Board may, by an order, allot any pending application to any Interim Board and may also transfer, by an order, any pending application from one Interim Board to another Interim Board.

- Where the pending application is allotted to an Interim Board or transferred to another Interim Board subsequently, all the records, documents or evidences, with whatever name called, with the ITSC shall be transferred to such Interim Board and shall be deemed to be the records before it for all purposes.

- Where the assessee exercises the option to withdraw his application, the proceedings with respect to the application shall abate on the date on which such application is withdrawn and the Assessing Officer, or, as the case may be, any other income-tax authority before whom the proceeding at the time of making the application was pending, shall dispose of the case in accordance with the provisions of this Act as if no application under section 245C of the Act had been made. However, for the purposes of the time-limit under sections 149, 153, 153B, 154 and 155 and for the purposes of payment of interest under section 243 or 244 or, as the case may be, section 244A, for making the assessment or reassessment, the period commencing on and from the date of the application to the ITSC under section 245C of the Act and ending with the date on which application is withdrawn shall be excluded. Further, the income-tax authority shall not be entitled to use the material and other information produced by the assessee before the ITSC or the results of the inquiry held or evidence recorded by the ITSC in the course of proceeding before it. However, this restriction shall not apply in relation to the material and other information collected, or results of the inquiry held or evidence recorded by the Assessing Officer, or, as the case may be, other income-tax authority during the course of any other proceeding under this Act irrespective of whether such material or other information or results of the inquiry or evidence was also produced by the assessee or the Assessing officer before the ITSC.

- The Central Government may make a scheme, by notification in the Official Gazette, for the purposes of settlement in respect of pending applications by the Interim Board, so as to impart greater efficiency, transparency and accountability by eliminating the interface between the Interim Board and the assessee in the course of proceedings to the extent technologically feasible; optimising utilisation of the resources through economies of scale and functional specialisation; and introducing a mechanism with dynamic jurisdiction. The Central Government may, for the purposes of giving effect to the said scheme, by notification in the Official Gazette, direct that any of the provisions of this Act shall not apply or shall apply with such exceptions, modifications and adaptations as may be specified in the notification. However, no such direction shall be issued after the 31st March, 2023. Every such notification issued shall, as soon as may be after the notification is issued, be laid before each House of Parliament.

These amendments will take effect from 1st February, 2021.

[Refer Clauses 54 to 65 of the Finance Bill’2021]

Analysis:-

The Hon’ble Finance Minister made a significant change to the well existing scheme of Settlement of Cases. The Finance Bill 2021 proposed the discontinuation of Income Tax Settlement Commission with immediate effect i.e. 1st February’2021. It is proposed to discontinue Income-tax Settlement Commission (ITSC) and to constitute Interim Board of settlement for pending cases.

The Income Tax Settlement Commission (ITSC) was a quasi-judicial body set up under the Income Tax Act. The objective of setting up of ITSC was to settle the tax liabilities in complicated cases, avoiding endless and prolonged litigation. The taxpayer could approach the ITSC during the pendency of assessment proceedings, subject to certain prescribed conditions. For making an application before the ITSC, the tax and interest on additional income disclosed before the ITSC has to be paid. The order passed by the ITSC is conclusive and no appeal to any authority can be made against the order.

Income Tax Settlement Commission was set up in the year 1976 on the recommendation of Direct Tax Enquiry Committee headed by former Chief Justice of India, Shri K. N. Wanchoo. The purpose, intent and necessity of Settlement Commission is revealed by recommendation in para 2.32 to 2.34 of Chapter of the report:

“2.32 This, however, does not mean that the door for compromise with the errant tax payer should forever remain closed. In the administration of fiscal laws, whose primary objective is to raise revenue, there has to be room for compromise and settlement. A rigid attitude would not only inhibit a onetime tax evader or an un intending defaulter from making a clear breast of his affairs, but would also unnecessarily strain the investigational resources of the department in cases of doubtful benefit to revenue, while needlessly proliferating litigation and holding up collections. We would, therefore, suggest that there should be a provision in the law for a settlement with the taxpayer at any stage of the proceedings. In the United Kingdom, the confession method has been in vogue since 1923. In the U. S. law also, there is a provision for compromise with the taxpayer as to his tax liabilities. A provision of this type facilitating settlement in individual cases will have this advantage over general disclosure scheme that misuse thereof will be difficult and the disclosure will not normally breed further tax evasion. Each individual case can be considered on its merits and full disclosures not only of the income but of the modus operandi of its build up can be insisted on thus sealing off chances of continued evasion through similar practice.

2.33 To ensure that the Settlement is fair, prompt and independent, we would suggest that there should be a high level machinery for administering the provisions, which would also incidentally relieve the field officer of an onerous responsibility and risk of having to face adverse criticism which, we are told, has been responsible for the slow rate of disposal of disclosure petitions.”

The Settlement Commission was a quasi judicial body and is a premier Alternative Dispute Resolution (ADR) body in India. The application for settlement can be made only during the pendency of the assessment proceedings and once during the lifetime. It is an institution, though within the Tax Department, but independent of the same to settle tax liability to give quietus to a dispute. In other words, the commission functions independently of the Department. It settles disputes relating to tax liability totally and finally. The biggest advantage of approaching ITSC was that it is empowered to grant immunity from prosecution for any offence and also to grant immunity from imposition of any penalty under the laws relating to Income Tax and Wealth Tax. The orders of the ITSC are final and not appealable. The orders are only subject to judicial review in terms of Articles 136 and 226 of the Constitution of India. Thus, time consuming litigation in regular appellate procedure is avoided by Department and assessee as well.

With the advent of Finance Bill ‘2021 , w.e.f. 01St February’2021, the assessee’s subjected to a search and seizure action cannot resort to the route of Settlement for prompt settlement of its cases as the commission itself has been discontinued. The search and seizure cases have also been kept out of the purview of newly introduced Dispute Resolution Committee by the Finance Bill’2021. The reason for the same appears to be obvious that the government wants to create utmost deterrence on tax evasion and it appears that the intent is that there should not be any room for any compromise and/or tax settlement in such cases.

Inequitable taxation on proactive application by charitable trust

While the Hon’ble finance minister began her speech in the parliament by acknowledging the prerequisite of augmenting the buying power of the citizen to compensate the throes of slowdown and unprecedent contraction of the global economy due to covid-19 pandemic, however the words in the speech could not sync with the action proposed in the finance bill, 2021.

In this article, we shall understand the repugnant impact of the proposed finance bill on the charitable trust which is registered under section 12AA of the Income-tax Act,1961 (‘the Act’) to provide relief to the poor, education, medical relief, advancement of any other object of general public utility etc.

- Clarification in the budget on the computation of total income of the trust

An Explanation 5 is proposed to be inserted in subsection (1) of Section 11 of the Act as “For the purposes of this sub-section, it is hereby clarified that the calculation of income required to be applied or accumulated during the previous year shall be made without any set off or deduction or allowance of any excess application of any of the year preceding the previous year”

- Basis of computation of total income of the trust before the above proposed clarification

The trust or institution registered under section 12AA of the Act is not liable to pay tax if it spends 85% of its total income for charitable purpose. The mechanism of computing total income of the assessee is provided under Chapter-IV of the Act which begins with section 14 and ends with section 59 of the Act. However, the income of the trust is to be computed under section 11 to section 13B of the Act which shall further be subject to the provisions of section 60 to section 63 of the Act.

In light of the said provisions, the computation of income of the trust used to be often questioned by the tax authorities to substantiate the basis of claiming deductions, exemptions and allowances which are provided under various provisions of the Act but were not explicitly provided under the provisions of section 11 to section 13B of the Act.

Central Board of Direct Tax (‘CBDT’) had put to rest the said dispute by issuing a clarification under the Circular No. 29, dated 23-08-1969 by providing that section 11 of the Act uses the word ‘income’ and not ‘total income’ which is provided in section 2(45) of the Act. Accordingly, various trust now takes a position that benefits in the form of deduction or allowance provided under various provisions of the Act shall be available to it.

- Feasibility of claiming excess application of prior years in the subsequent years, before the above proposed clarification

It is worthwhile to note that there is no explicit provision under the Act that enables a trust to set-off the losses incurred in the prior years against the income in the subsequent year nor the same can be disclosed explicitly anywhere in the return of income of the trust in ITR-7. However, the judiciary had on various occasion discussed on allowability to carry forward and set-off of excess application of the prior years against the surplus in the subsequent year. The Principles enumerated from the jurisprudence is provided as follows:-

- It is the well-settled position that income derived from the trust property must be determined on commercial principles.

- if commercial principles for determining the income are applied, it is but natural that the adjustment of the expenses incurred by the trust for charitable and religious purposes in the earlier year against income earned by the trust in the subsequent year will have to be regarded as application of income of the trust for charitable purposes in the subsequent year.

- The amount so applied in the subsequent year will have to be excluded from the income of the trust under section 11(1)(a).

The aforementioned principles were concurred by various courts in the past as follows:-

- Gujrat High Court in the case of Shri Plot Swetamber Murti Pujak Jain Mandal [TS-5781-HC-1993(GUJARAT)-O]

- Bombay High Court in the case of Institute of Banking Personnel Selection [TS-31-HC-2003(BOMBAY)-O]

- Madras High Court in the case of Matriseva Trust [TS-5134-HC-1999(MADRAS)-O]

- Delhi High Court in the case of Raghuvanshi Charitable Trust [TS-133-HC-2010(DELHI)-O]

- Karnataka High Court in the case of Ohio University Christ College [TS-7046-HC-2018(KARNATAKA)-O]

Impact of proposed clarification- More tax outflow on excess application

For the ease of reading, it is hereby reiterated that the proposed clarification in the budget restricts set off or deduction or allowance of any excess application of any of the year preceding the previous year against the income of the previous year of the trust. How such provision shall put the assessee trust in a worser position in the event of accelerated application of receipts for charitable purpose is provided in the following instance:-

|

Year |

Particulars |

Scenario:1 Before clarification |

Scenario:2 After clarification (Version-1) |

Scenario:3 After clarification (Version-2) |

|

1

|

|

100 (15) 85 (120) (35) |

100 (15) 85 (120) (35) |

100 (15) 85 (85) Nil |

|

2

|

|

100 (15) 85 (50) (35) Nil

|

100 (15) 85 (50) Nil 35

|

100 (15) 85 (85) Nil Nil |

- In Scenario-1, the trust had earned Rs.200 and expended Rs. 170 in 2 years and was not liable to any tax considering above judicial precedents.

- In Scenario-2, the trust had earned Rs.200 and expended Rs. 170 in 2 years but was also liable to tax on income of Rs.35 because it had incurred more amount towards charitable purpose in Year-1 but could not set-off such excess application in year-2.

- In Scenario-3, the trust had earned Rs.200 and expended Rs. 170 in 2 years and was not liable to tax because it had applied its income only to the extent of 85% in each of the year -1 and year-2.

From the above analysis, it can be apparently seen that a trust which had applied its income on early basis is liable to higher tax in comparison to the trust which had deferred the application of income to the subsequent year. The action proposed in the finance bill therefore has the effect of deprivation of concession granted and is repugnant to the intended outcome.

The Hon’ble Finance minister may look into the outcome of the proposed clarification as this will adversely impact the tax liability of the trust which had applied excess funds over income in comparison to the trust which had deferred the application of its income for charitable purposes.

Thoughts to ponder

- One may think that the excess application of income may be out of the borrowed funds and the newly inserted Explanation-4 to section 11 of the Act is providing the allowance in the year of repayment of such funds, so the loss in scenario-2 can be adjusted against the income in year-2 by repaying the excess amount expended out of the borrowed funds. However, it must be noted here that if the amount expended out of the internal accruals of 15% or out of the corpus fund, then such excess expenditure could be a permanent loss to the trust as the same is no more allowable as deduction to the trust.

- The amendment proposed in the finance bill, 2021 is by way of insertion of explanation in the form of clarification with effect from 01st April,2022. Since the amendment proposed is by way of clarification, whether the same shall be effective from 01st April 2022 or shall have retrospective effect.

- If the effect of the said clarification is retrospective in nature, can the case of the assessee trust on account of set-off of earlier year excess application be reopened by the tax authorities in the following scenarios:-

- Allowance is to be treated as act prejudicial to the revenue and subject to revision by the Commissioner under section 263 of the Act.

- Clarification enables the tax authorities to amend the order under section 154 of the Act, as mistake apparent from record.

- Allowability of the claim has a reason to believe that income of the trust had escaped assessment.

Thanks for reading and trust the same was useful!

GST Budgetary Proposals – Limited Amendments, Overarching Impact

This Budget, unlike many previous budgets, was keenly awaited since it was announced after a ‘once in a century’ event. With the sharp decline in overall tax collections, although the Goods and Services Tax (‘GST’) had picked up increasing pace in the last few months, there was a wide anticipation of a new Covid Cess. No additional tax was introduced, which has provided a boost for industry; although there is an Agriculture Infrastructure and Development Cess (‘AIDC’). The AIDC replaces basic custom duties or excise duties which are not creditable and hence does not lead to an increase in taxes.

The morning of the Budget day brought cheers for the Finance Minister with the announcement of record GST collections to the tune of Rs 1.20 lakh crores. The largest ever collection of GST is an indicator of a revival of economic activities. Another key reason could be as a result of stringent measures being taken against tax evaders. We are witnessing an increasing number of arrests for fraudulent transactions like fake invoicing, which is contributing to a rise in tax collections as ineligible input tax credits are being identified and weeded out.

This trend of the last few months has been closely adopted by various budgetary provisions. The provisions relating to provisional attachment of property like bank accounts has been significantly widened. It can now be resorted to in the case of any action being initiated by the tax authorities pertaining to assessment, investigation, search and seizure etc. Thus far, provisional attachment could be resorted to in specific situations like non-filing of returns, unregistered persons and summary assessment. Any action by the tax authorities, beyond the permissible situations, had been challenged before various High Courts which had appropriately restricted the powers to invoke provisional attachment for breaches specified in the law. With a view to providing unfettered power to protect the interests of the revenue authorities, the scope has been significantly enhanced to include the coverage discussed above. Given the wide latitude available to the tax authorities, laying down a broad framework within which such powers should be exercised, would be a welcome step.

Another important change is insertion of an additional condition for taking eligible input tax credit. The proposed amendment requires that the invoice details must be uploaded by the supplier and communicated to the recipient in the manner specified in Section 37 of the Central Goods and Services Tax Act (‘CGST law’). This amendment will now provide the statutory basis for the government’s intention of allowing the input tax credit only when the invoice details are uploaded on the GSTN portal. This requirement was one of the primary conditions as envisaged when GST was introduced. However, since GSTR 2 and 3 were discontinued after one month of GST implementation, an argument was possible that if all conditions specified in Section 16 of the CGST law were complied with, the input tax credit cannot be denied even if the invoice details were not uploaded by the supplier. With this new condition, the tax authorities have sought to dispel any doubts and made it mandatory for the supplier to upload the invoice details; otherwise, the benefit of the input tax credit will be denied to the recipient. A related question arises: if a supplier has failed, for any reason, to upload the invoice details within the specified time as per Section 37, and is done belatedly, will it result in denial of input tax credit?

The definition of supply has been expanded to include activities between any person, other than individual, and its constituents or members, as deemed supply, to overcome the principle of mutuality. The Supreme Court in the case of Calcutta Club Vs Union of India had extended the principle of mutuality to service tax law, if the entity in question was an incorporated entity. Whilst the service tax law had introduced a deeming fiction to treat activities between an unincorporated association and its members as deemed supply, it was held not to be applicable if the entity was incorporated. Under the GST law, no deeming fiction had been inserted, regardless of whether or not the entity was incorporated, to treat a transaction between an association and its members as a deemed supply, if it satisfied the test of mutuality. With this amendment, it may no longer be possible to argue against non-taxability of such transactions. However, the question would remain open for past transactions. Whilst the deeming fiction has been introduced with retrospective effect, the argument of the validity of the retrospective amendment may still be litigated.

Also, as a consequence of this amendment, the entry in Schedule II of the CGST law which provided that any supply of goods by an unincorporated association to its members will be treated as supply of goods, has been deleted. This entry had been inserted to provide a deeming fiction of supply to tax such transactions.

In a welcome move, the government has omitted the requirement for mandatory certification of reconciliation statement in GSTR 9C by specified professionals like Chartered Accountant etc. It has replaced the requirement of mandatory certification with self-certification. Thus, whilst the requirement of mandatory certification has been done away, the activity of reconciliation still needs to be carried out and the reconciliation statement needs to be filed alongwith the annual return.

Another amendment which will have far reaching impact on the cash flows of a company is withdrawal of the default option of paying Integrated Goods and Services Tax (‘IGST’) on export goods and claiming a refund thereof. This option had been opted for by several companies as it helped in faster liquidation of accumulated input tax credits. Under this option, it was also possible to take a refund attributable to GST paid on capital goods. Withdrawal of this option would mean that the only recourse available for refund of unutilized accumulated input tax credit, would be to opt for Rule 89 of CGST Rules. Companies had been avoiding this route since it is characterized by a delay in granting a refund, and often disputed by the department on the grounds of ineligibility of input tax credit. Also, the GST paid on capital goods is not available as a refund. Thus, a company with substantial exports will find itself in a sticky situation where not only may it take longer to claim refund of input tax credit but also refund of input tax credit pertaining to capital goods will not be available. This will have an impact on the working capital of the company.

Going forward, if an exporter is unable to recover the foreign exchange within the time limits specified as per RBI guidelines, then the benefit of refund obtained for such exports will be required to be returned along with interest. The intention seems to deny the refund if the foreign exchange has not been realized. But can the company reinstate the input tax credit if it is returning the refund amount in cash? Since the refund obtained earlier was of input tax credit, it would be logical to presume that the input tax credit should be reinstated. Also given that it could be a revenue-neutral exercise i.e. return of cash refund and reinstatement of input tax credit, it would be interesting to see whether demand of interest would be sustainable, especially given the fact that section 50 of the CGST law has adopted the philosophy that interest should be recovered only if there is a net cash tax liability.

Another welcome amendment is giving retrospective effect to Section 50 of CGST law which provides that interest is payable only if there is a net cash tax liability. This had been clarified by the government earlier but providing the statutory mechanism of retrospectivity would remove any ambiguity on this matter for its applicability to the past transactions.

The amendment to GST provisions is also required to be done in all state GST laws. Thus, the majority of the provisions will be made effective by a separate notification, once every state GST law has been amended.

Dissolution or Reconstitution of Firm - Rub Salt Into the Wound?

This article has been co-authored by Shraddha J. Shah (Senior Manager), Tax and Transfer Pricing, Nexdigm (SKP).

BACKGROUND

Section 45(4) of the Income Tax Act, 1961 (IT Act) provides that profits or gains arising from transfer of capital asset by way of distribution of capital assets on dissolution of firm (or association of persons (AOP) or body of individuals (BOI)) or otherwise are chargeable to tax as income of the firm or AOP or BOI.

The applicability of this Section has been under the scanner for situations where distribution of capital asset takes place during existence of partnership firm, assets of the firm are transferred to a retiring partner, or where subsisting partners of the firm transfer assets in favor of a retiring partner. The Bombay High Court ruling[1] accorded wide scope to the words ‘otherwise’ and thereby concluded that the situations mentioned above trigger provisions of Section 45(4) of the IT Act. However, at a later stage, there were rulings of the Madras High court[2] and the Bombay High Court[3] where a favorable view was adopted, and it was held that where a partner receives an asset at the time of retirement, it is his own share of interest in the firm and thus, not a transfer liable to tax.

Another area of dispute pertained to the aspect as to whether considerations (amount equal to their capital balance or asset equivalent to capital balance) paid to retiring partners is nothing but their share of interest in the firm, then accordingly, no capital gain tax is leviable. The Supreme Court[4] had given a favorable order on this issue, but some adverse decisions have renewed the debate.

ISSUE SOUGHT TO BE ADDRESSED BY FINANCE BILL

The Memorandum to Finance Bill, 2021 noted that there is uncertainty regarding the applicability of Section 45(4) to situations where assets are revalued or self-generated assets recorded in the books of accounts, and also when payment is made to a retiring partner or member in excess of his capital contribution.

AMENDMENT BY FINANCE BILL, 2021

We have summarized below the Finance Bill provisions of substituted Section 45(4) and new section 45(4A) that are proposed to be made applicable from 1 April 2020 (Financial Year 2020-21). These provisions apply to specified entities, namely firms or AOPs or BOIs (other than companies and co-operative societies) in respect of specific circumstances involving specified person i.e. a person who is a partner of such firm or AOP or BOI in any previous year.

For the sake of creating a brief summary, we have referred to firm and partner in the table below. This will also apply similarly in the case of AOPs or BOIs and their members.

|

Section |

Taxability of - asset in question |

Taxable event |

Taxable in the hands of and year of taxability |

Computation mechanism for Capital Gains |

|

45(4) |

Capital asset representing balance in partner’s capital account in the books of accounts of the firm at the time of dissolution or reconstitution of the firm |

Partner receives any capital asset at the time of dissolution or otherwise of the firm |

Profits or gains arising from receipt of such capital asset chargeable to tax as income of firm in the previous year in which it was received by the partner

|

Fair market value of capital asset on date of receipt less cost of acquisition of capital asset determined as per provisions of this Chapter |

|

45(4A) |

Money or other asset that is in excess of balance in partner’s capital account in the books of accounts of the firm at the time of dissolution or reconstitution of the firm |

Partner receives such money or other asset at the time of dissolution or reconstitution of the firm |

Profits or gains arising from receipt of such money or other asset chargeable to tax as income of firm in the previous year in which it was received by the partner

|

Value of any money or fair market value of other asset on the date of receipt less balance in capital account of the partner in the books of accounts of firm at the time of its dissolution or reconstitution |

For the purpose of both the Sections, balance in capital account is to be calculated without taking into account increase in capital due to revaluation of any asset or due to self-generated goodwill or any other self-generated asset. Self-generated goodwill and self-generated asset are defined to mean goodwill or asset that has been acquired without incurring any cost for purchase or which has been generated during the course of business or profession.

ANALYSIS AND IMPACT

The scope of taxation under Section 45(4) till now that was restricted to capital assets is proposed to be enlarged to cover money and other assets as well. Also, the new provisions incorporating the word ‘receives’ as against the words ‘transfer’, ‘distribution’ in erstwhile provisions widens the coverage. The applicability is not just restricted at the time of dissolution but also covers cases of reconstitution, thereby encompassing even cases of admission or retirement of partners, conversion of firm or succession of firm by a company. The provisions have not been restricted to the receipt by partner from a specific entity, thus even if a partner receives capital assets or money or other assets from other partners at the time of reconstitution of firm, it shall stand covered by the rigors of Section 45(4) and 45(4A). Apart from firm and limited liability partnerships (treated as firm as per Section 2(23)), if a trust constitutes AOP, these provisions will apply accordingly. However, what will be covered within the ambit of reconstitution in case of a trust as an AOP is unclear.

With respect to the proposed substituted Section 45(4), the decision of Supreme Court and other Courts[5] advocating that what the partner receives at the time of retirement is his own share of interest in the firm, and thus not taxable, are sought to be reversed. Effectively, the new provisions seek to tax share or interest of a partner in the firm and its assets (without revaluation effect). The mode of settlement of the retiring partner’s claim– irrespective of allotment of capital asset or other asset or through money - is taken into account.

The provisions are proposed to be applicable from Financial Year 2020-21. Considering this, if the taxable event as per Section 45(4) and 45(4A) has occurred during the period 1 April 2020 till date, the same shall be taxable in the hands of firm.

Probably, these provisions can be labelled as Exit Tax for partners, but taxable in the hands of the firm. The special purpose vehicles set up by way of partnership firms or limited liability partnerships will be hit by these provisions. Such entities that had operational flexibilities with respect to distribution of profits to partners will have to put on their thinking caps with the introduction of such provisions.

This article has been co -authored by Shraddha J. Shah Senior Manager Direct Tax Nexdigm (SKP)

[1] A.N. Naik Associates [TS-29-HC-2003(BOM)-O]

[2] National Company -

[3] Electroplast Engineers -

[4] Mohanbhai & Pamabhai [TS-5006-SC-1987-O]

[5] Dynamic Enterprises [TS-556-HC-2013(KAR)-O] (Karn) [FB]

Taxing Time for Firm on Partner Taking Over Asset or Money Upon Dissolution or Reconstitution

This article has been co-authored by Deepa Sheth (Chartered Accountant).

Taxing time for firm on partner taking over asset or money upon dissolution or reconstitution[1]

Existing Provisions – Transfer of capital asset

As per the existing provisions of section 45(4) of the Income-tax Act, 1961 (‘Act’), profits or gains arising from the transfer of a capital asset by way of distribution of capital assets on the dissolution of a firm or Association of Persons (‘AOP’) or Body of Individuals (‘BOI’)[2] or otherwise, shall be chargeable to tax under the head Capital gains and shall be deemed to be the income of the firm or AOP or BOI of the year in which the said transfer takes place. Further, the Fair Market Value (‘FMV’) of the asset on the date of such transfer shall be deemed to be the full value of consideration received or accruing as a result of such transfer. With regard to the term ‘otherwise’, it has to be read in conjunction with the words 'transfer of capital assets by way of distribution of capital assets’. Accordingly, several courts have held that the term 'otherwise' takes into its sweep not only cases of dissolution but also cases of subsisting partners of a firm, transferring assets in favour of a retiring partner[3]. Additionally, for the purpose of charging tax on the transfer of a capital asset by way of distribution of capital assets on the dissolution of the firm, one need not look into the definition of the term 'transfer' as mentioned in section 2(47)[4] of the Act.

Loophole in the existing provision – receipt of money

However, there is uncertainty regarding applicability of provisions of section 45(4) of the Act to a situation where assets are revalued or self-generated assets are recorded in the books of accounts; profits from such upwards revaluation is distributed or credited to the capital balances of partners; and immediately thereafter money is being paid to retiring partner which may or may not be in excess of the capital balance.

Some of the judicial precedents on this subject which were in favour of taxpayers are as under:

- CIT v. Dynamic Enterprises [2013] [TS-556-HC-2013(KAR)-O] (Karnataka HC)

The full bench decision of the Hon'ble Karnataka High Court has held that when retiring partner took cash towards value of his share in firm, there was no distribution of capital assets among the partners and there was no transfer of capital asset and therefore no profits or gains are chargeable to tax under section 45(4) of the Act. Similar view was taken by the same High Court in the case of CIT v. Karnataka Agro Chemicals [TS-465-HC-2014(KAR)-O] [2014] (Karnataka). Further, the Hon’ble Mumbai ITAT[5] in various cases have decided in favour of taxpayer relying on the above decision of the Karnataka HC.

Interestingly, in the case of Mahul Construction Corporation (2017) 168 ITD 120 (Mumbai - Trib), it was held that payment of cash by firm for settlement of retiring partner's revalued capital balances was not held to be distribution of capital asset as contemplated in section 45(4) of the Act and accordingly held that entire revaluation surplus already distributed to retiring partners was not taxable in hands of firm.

- PCIT v. Electroplast Engineers [2019] [TS-5274-HC-2019(BOMBAY)-O] (Bombay)

Under a deed of reconstitution of the firm, three new partners were admitted. Another Deed of retirement cum reconstitution of the firm was executed by which the original two partners, who constituted the firm, retired from the firm and the remaining three partners redistributed their share in a firm. Goodwill was valued and credited in books of the firm and the retiring partners were partly paid cash towards their share of goodwill in proportion of their share in firm. In this case, the question was whether section 45(4) of the Act would apply even if there was no dissolution but reconstitution of the firm. The Tribunal observed that the firm's assets were revalued and the retiring partners were paid their share of the partnership asset which was affirmed by the High Court. Since there was no transfer of capital asset by way of distribution upon reconstitution of firm, it was held by the Bombay High Court that sum paid by assessee-firm to retiring partners would not constitute capital gain under section 45(4) of the Act.

The taxpayers may not be able to seek shelter relying on these judicial pronouncements once the proposed amendments (which are discussed below) by the Finance Bill 2021 are made effective.

Proposed Amendments by Finance Bill 2021

- Receipt of capital asset

Finance Bill 2021 proposes to substitute the existing sub-section (4) of section 45 of the Act with a new sub-section (4) and also insert a new sub-section (4A) to this section.

As per the newly proposed sub-section (4) of section 45 of the Act, profits or gains arising from the receipt of a capital asset by the partner or member of firm or AOP or BOI at the time of dissolution or reconstitution of the firm or AOP or BOI, which represents the balance in the capital account of such partner or member in the books of the firm or AOP or BOI at the time of its dissolution or reconstitution shall be chargeable to tax under the head Capital gains and shall be deemed to be the income of such firm or AOP or BOI for the year in which such capital asset was received by such partner or member.

Further, for the purposes of section 48 of the Act, FMV of such capital asset as on the date of such receipt shall be deemed to be the full value of consideration received or accruing as a result of such transfer in the case of firm or AOP or BOI. Also, the cost of acquisition of such capital asset in case of firm or AOP or BOI shall be determined in accordance with the provisions of the Chapter IV-E. Further, the balance in the capital account of the partner or member in the books of account of the firm or AOP or BOI is to be calculated without taking into account increase in the capital account of the partner or member due to revaluation of any asset or due to self-generated goodwill or any other self-generated asset[6].

- Receipt of money or other asset

Further, notwithstanding anything contained in sub-section (1)[7] of section 45 of the Act, a new sub-section (4A) has been proposed to be introduced in section 45 of the Act which applies in a case where a partner or member receives, during the fiscal year, any money or other asset at the time of dissolution or reconstitution of the firm or AOP or BOI. Where money or other asset is in excess of the balance in the capital account of such partner or member in the books of accounts of the firm or AOP or BOI at the time of its dissolution or reconstitution, then profits or gains arising from the receipt of such money or other asset by the partner or member shall be chargeable to income-tax as income of the firm or AOP or BOI under the head ‘Capital gains’ and shall be deemed to be the income of such firm or AOP or BOI of the previous year in which the money or other asset is received by the partner or member.

For the purposes of section 48 of the Act, value of the money or the FMV of other asset on the date of such receipt shall be deemed to be the full value of the consideration received or accruing as a result of the transfer of other asset. Further, the balance in the capital account of the partner or member in the books of accounts of the firm or AOP or BOI at the time of its dissolution or reconstitution shall be deemed to be the cost of acquisition. The balance in the capital account of the partner or member in the books of account of the firm or AOP or BOI is to be calculated without taking into account increase in the capital account of the partner or member due to revaluation of any asset or due to self-generated goodwill or any other self-generated asset.

Further, in order to mitigate double taxation, consequential amendment is also proposed in section 48 of the Act to provide that the amount included in the total income of firm or AOP or BOI under sub-section (4A) of section 45 which is attributable to the capital asset being transferred, shall be reduced from the full value of the consideration to compute income chargeable under the head Capital Gains in a manner which is to be prescribed later.

Issues emanating from the proposed amendments

On bare reading of these amendments, some of the key issues emanating are as under -

- Capital Gains vs Business income / Other Sources

Section 45 of the Act covers transactions in respect of transfer of capital asset and thereby any profits or gains arising from such transfer shall be chargeable to tax under the head Capital Gains and deemed to be income of the year in which transfer takes place. However, by virtue of section 45(4A) of the Act, the Finance Bill proposes to cover transfer of other asset or money (not being a capital asset) which may be chargeable to tax under the head Business Income or Other Sources and accordingly it may not be apt to tax under the head Capital Gains.

- Transfer of capital asset vs stock in trade

The above proposals provide that in case of transfer of capital asset, tax is levied on the firm provided such capital asset represents the outstanding capital balances of the partner. However, in case of transfer of other asset, tax is levied on the firm only if FMV of other asset exceeds outstanding capital balance of partners or members in the books of accounts of firm. Thus, for instance, in case where real estate developer firm, holding a plot of land as stock in trade, transfers such land to the retiring partner, then the firm would be taxable on the difference of FMV of land and the outstanding capital balance of the retiring partner in the books of accounts of the firm. In this regard, it is pertinent to note that the actual cost of such stock in trade in the books of such firm (which may be higher than the outstanding capital balance) would not be considered. On the other hand, where the land is held as capital asset by a firm is transferred to the retiring partner, then firm would be taxable on difference of FMV of land and the cost of acquisition/improvement in connection with the land after providing necessary indexation to such cost. Thus, it is pertinent to note that the tax computation with respect to cost of land would change depending on the fact whether such land is held as capital asset or stock in trade by the firm.

- Interplay between section 45(2) and section 45(4A)

This issue can be better understood by way of following illustration:

Land, being capital asset of a firm, is converted into stock in trade. Now, as per the provisions of section 45(2) of the Act, profits or gains arising from transfer by way of conversion of land as capital asset into stock in trade shall be chargeable to income-tax as an income of the year in which such stock in trade is sold or otherwise transferred by the firm. Thus, firm will be locking its tax liability as on the date of conversion which shall be discharged only at the time of sale of such stock in trade. Further, at the time of conversion, the firm revalues such land (at the conversion value on which tax is payable) and distributes such revalued amounts in the capital accounts of partners. Thereafter, let us say few years later, the said land, being stock in trade, is taken over by the retiring partner. In such scenario, how would the provisions of section 45(2) and section 45(4A) of the Act be given harmonious effect is an issue that requires deliberations.

- Reducing revalued amounts from the outstanding capital balances of partner

At the time of dissolution or reconstitution, the proposed amendment requires to calculate the balance in the capital account of the partner in the books of account of the firm without taking into account increase in the capital account of the partner due to revaluation of any asset. However, no timeline has been prescribed within which the effect of such revaluation needs to be given to the outstanding capital account balances. Thus, in case where asset has been revalued by the firm in 2020 (and such revalued amount have been distributed to partners in the same year) and thereafter in subsequent year(s) partner decides to retire and take over the said asset whether the impact of such revalued amounts needs to be given to the outstanding capital balance of the partner? Also, considering the fact that in a given year, the capital account of a partner would comprise of capital introduced by the partner, remuneration and share of profit, interest on capital, drawings and interest thereon, etc and therefore there is a need to prescribe a mechanism to determine the amount which needs to be reduced from the outstanding capital balances of partner.

- Applicability

The above amendments are proposed to be made effective retrospectively, i.e., from 1-April-2020, and would cover transaction entered during the fiscal year 2020-21. As a result, there may be firms wherein partner(s) have retired or firm has been reconstituted (on or after April 2020) and the outgoing partners have taken over capital asset, any other asset or money. In such cases, the firm would now be liable to capital gains tax and may have defaulted in payment of advance tax instalments on account of such capital gains tax. This may also lead to interest implications on the default of payment of the advance tax instalments.

- Loss scenario

By virtue of the above proposed amendments, profits or gains arising from the receipt of a capital asset or other asset by partner or member at the time of dissolution or reconstitution of firm or AOP or BOI shall be chargeable to tax under the head Capital gains in the hands of such firm or AOP or BOI in the year in which such capital asset was received by the partner or member. In a converse case, where the partner or member receives less on his retirement, there has to be suitable amendments to allow such loss in the hands of the firm.

Concluding thoughts

Though the intention of the government in introducing these provisions was to rationalise and plug the loophole which taxpayers have explored in the past, however these proposed amendments have opened up separate set of questions or concerns which requires early resolution.

[1] This article has been co-authored by Bhavin Shah (Chartered Accountant) and Deepa Sheth (Chartered Accountant). The views expressed in this article are personal view of authors and does not resemble any professional advice.

[2] Not being a company or a co-operative society

[3] CIT v. A.N. Naik Associates [2004] [TS-29-HC-2003(BOM)-O] (Bom.), Bharat Ginning & Pressing Factory v. ITO [2013] [TS-5471-ITAT-2013(AHMEDABAD)-O] (Ahd.), Asstt. CIT v. D.D. International (Global) [2009] (Asr.), Vikas Academy v. ITO [2015] [TS-5711-ITAT-2015(CHENNAI)-O] (Chennai)

[4] Swamy Studio v. ITO [1998] [TS-5272-ITAT-1997(MADRAS)-O] (Mad. - Trib.)

[5] James P. D'Silva v. DCIT [2019] [TS-5983-ITAT-2019(MUMBAI)-O] (Mumbai - Trib.) and Keshav & Company v. ITO [2016] [TS-6654-ITAT-2016(MUMBAI)-O] (Mumbai - Trib.) and Mahul Construction Corporation v. ITO [2017] [TS-7600-ITAT-2017(MUMBAI)-O] (Mumbai - Trib.)

[6] The term ‘self-generated goodwill’ and ‘self-generated asset’ has been defined to mean goodwill or an asset which has been acquired without incurring any cost for purchase or which has been generated during the course of the business or profession by the firm or AOP.

[7] Any profits or gains arising from transfer of capital asset effected in the year shall be chargeable to income-tax under the head ‘Capital Gains’ and shall be deemed to be the income of the year in which transfer took place.

Removal of Depreciation on Goodwill

This article has been co-authored by Suril Mehta (Associate Director), K C Mehta & Co.

After the landmark Supreme Court judgement of Smifs Securities, goodwill was considered as a capital asset eligible for depreciation. This decision was pronounced in 2012 and has gained fame and since it provided support in claiming depreciation on goodwill generated on transactions like Amalgamation, Demerger, Slump sale, etc. Post Smifs Securities, there have been many judgements on this aspect – most of them have been in favour of the taxpayer.